FACILITIES LEASE

between

CEDARS-SINAI MEDICAL CENTER,

a California nonprofit public benefit corporation

and

Capricor, Inc.

a Delaware corporation

FACILITIES LEASE

THIS FACILITIES LEASE (“Lease”) is made and entered into as of June 1, 2014, by and between CEDARS-SINAI MEDICAL CENTER, a California nonprofit public benefit corporation (“Landlord”), and CAPRICOR, INC., a Delaware corporation (“Tenant”), with reference to the following facts and circumstances:

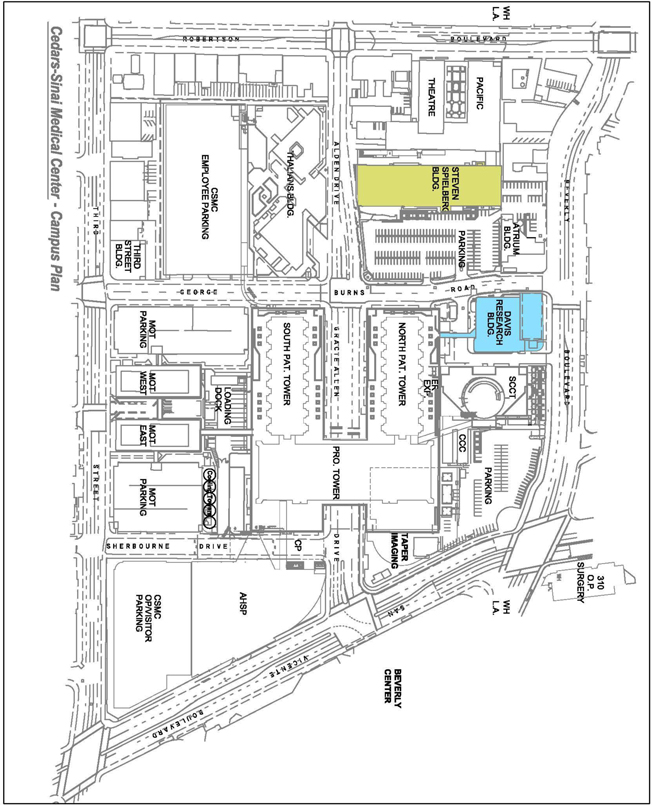

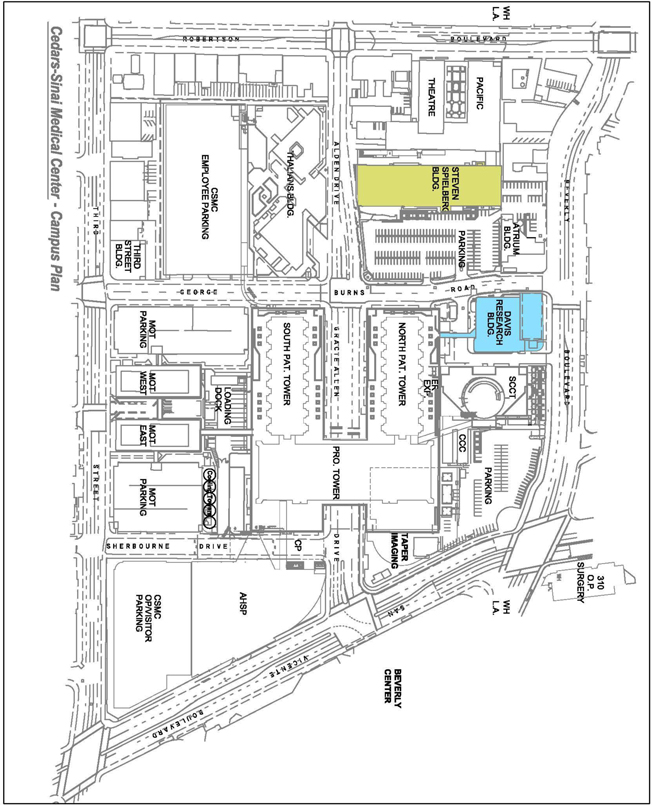

A. Landlord is the owner of buildings located at 110 George Burns Road, Los Angeles, California (the “Davis Building”) and 8723 Alden Drive, Los Angeles California (the “SSB1 Building”) (each of the Davis Building and the SSB1 Building alone, a “Building” and collectively, the “Buildings”). The land upon which the Davis Building is located is hereinafter referred to as the “Davis Property” and the land upon which the SSB1 Building is located is hereinafter referred to as the “SSB1 Property” (the Davis Property and the SSB1 Property, collectively, the “Property”). Site plans depicting the Buildings, related improvements and the Property (collectively, the “Project”) are attached hereto as Exhibit A.

B. Tenant is currently leasing certain space in the Davis Building from Landlord pursuant to that certain Lease dated January 1, 2008 (the “Expired Lease”), which space is now being leased by Tenant on a month-to-month basis. Landlord and Tenant agree that upon the Commencement Date of this Lease, the Expired Lease shall be deemed superseded hereby and shall no longer be of force or effect, except with respect to any obligations which were intended to survive the termination thereof.

C. Landlord desires to lease certain space within the Buildings to Tenant and Tenant wishes to lease such space within the Buildings from Landlord, in accordance with the terms and conditions stated herein.

D. Tenant is leasing certain space within the Buildings for the purpose of conducting Biomedical Activities.

E. Landlord and Tenant intend that the execution, delivery and performance of this Lease by each party, and the consummation of the transactions contemplated hereunder, shall not at any time threaten Landlord’s tax-exempt status under Section 501(c)(3) of the Internal Revenue Code and Section 23701d of the California Revenue and Taxation Code, or cause Landlord to be in default under any of Landlord’s issued and outstanding tax-exempt bonds.

NOW, THEREFORE, for mutual consideration, the receipt and sufficiency of which are hereby acknowledged, Landlord and Tenant hereby agree as follows:

| Execution Copy | 2 |

ARTICLE

I

BASIC LEASE PROVISIONS

Wherever referred to in this Lease, and subject to modification or revision by particular terms and conditions of this Lease and Addenda thereto, these certain basic lease provisions are defined as follows:

1.1 Tenant: Capricor, Inc., a Delaware corporation.

1.2 Buildings: 110 George Burns Road and 8723 Alden Drive.

1.3 Premises Area: 1,935 total rentable square feet, consisting of:

1.3.1 Rooms 1099, 1099A, and 1100 of the Davis Building, consisting of 652 usable square feet (the “Davis Building Premises”);

1.3.2 Rooms 143, 143A, and 143B of the SSB1 Building, and Fifty percent (50%) of the usable square feet contained in Rooms 149 and 150 of the SSB1 Building, consisting of 1,004 usable square feet (collectively, the “SSB1 Building Premises”);

1.3.3 Tenant’s share of the gross square feet contained in the Common Services Space and the Common Areas of the Davis Building, which shall be an additional fifteen percent (15%) of the total usable square feet of the “Davis Building Premises” described in Section 1.3.1 above (equaling 98 square feet) bringing the total rentable square footage for the Davis Building Premises to 750 square feet.

1.3.4 Tenant’s share of the gross square feet contained in the Common Services Space and the Common Areas of the SSB1 Building, which shall be an additional eighteen percent (18%) of the total usable square feet of the “SSB1 Building Premises” described in Section 1.3.2 above (equaling 181 square feet) bringing the total rentable square footage for the SSB1 Building Premises to 1185 square feet.

1.4 Commencement Date: June 1, 2014.

1.5 Termination Date: May 31, 2017.

| 3 |

1.6 Permitted Uses: Biomedical Activities, as set forth in Section 6.1 and more particularly described in Exhibit D.

1.7 Total Monthly Payment:

1.7.1 $15,460.65, beginning on the Commencement Date and continuing on the first day of each subsequent calendar month for the first six months of the Term hereof. The Total Monthly Payment includes: (i) the “Basic Monthly Rent” for the first six months of the Term hereof of $11,590.65; and (ii) an “Additional Monthly Rent” of $3,870.00 for Operating Expenses.

1.7.2 $19,350.00, on the first day of each subsequent calendar month after the first six months of the Term hereof. The Total Monthly Payment includes: (i) the “Basic Monthly Rent” of $15,480.00; and (ii) an “Additional Monthly Rent” of $3,870.00 for Operating Expenses.

1.8 Basic Annual Rent:

1.8.1 $162,423.90 , for the first year of the Term hereof. The value for Basic Annual Rent found in this Section 1.8.1 shall not be used for any adjustments made from time to time pursuant to Section 4.2 hereof.

1.8.2 $185,760.00, for all years subsequent to the first year of the Term hereof. The value for Basic Annual Rent found in this Section 1.8.2 shall be used for any adjustments made from time to time pursuant to Section 4.2 hereof.

1.9 Basic Annual Rent Increase: Effective on each and every anniversary of the Commencement Date, pursuant to Section 4.2.

1.10 Additional Rent: $46,440.00 annually (or $3,870.00 per month) for Operating Expenses, pursuant to Section 4.3.

| 4 |

1.11 Total Annual Rent:

1.11.1 $208,863.90 for the first year of the Term hereof, consisting of the Basic Annual Rent set forth in Section 1.8.1 plus the Additional Rent set forth in Section 1.10.

1.11.2 $232,200 for all years subsequent to the first year of the Term hereof, consisting of the Basic Annual Rent set forth in Section 1.8.2 and the Additional Rent set forth in Section 1.10, subject to adjustments as set forth elsewhere in this Lease.

1.12 Security Deposit: $38,700.00.

1.13 Parking Allotment: See Section 29.23 hereof

ARTICLE

II

DESCRIPTION OF PREMISES

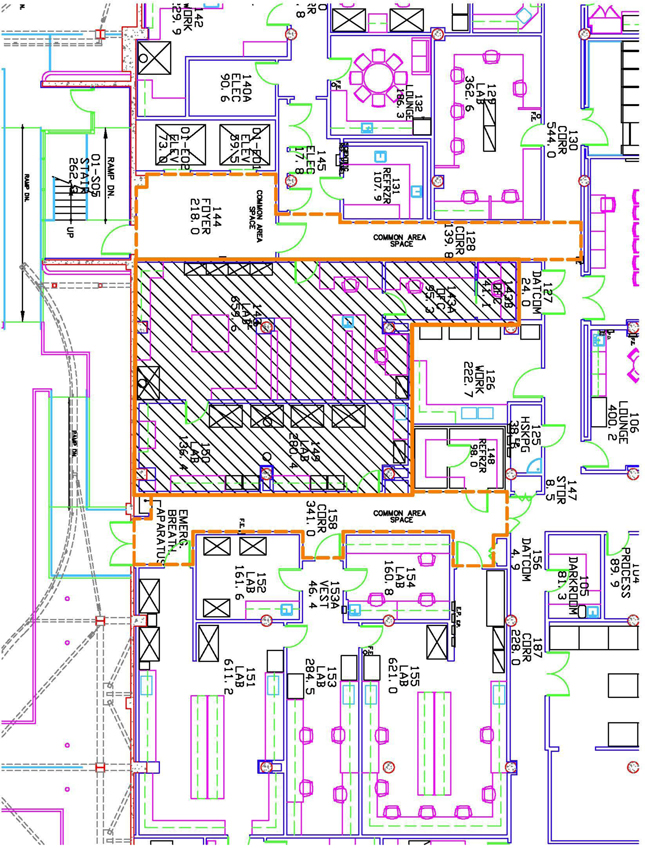

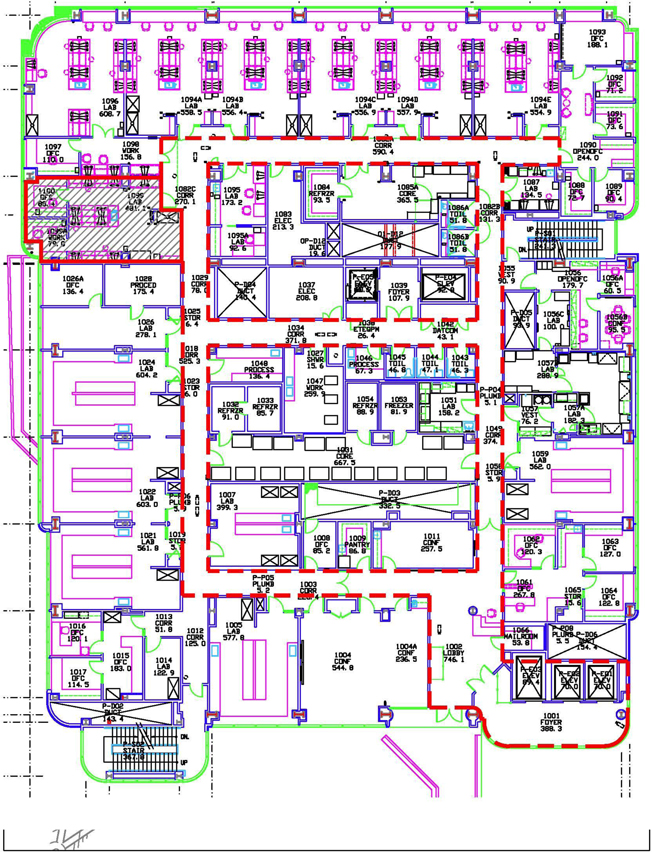

2.1 Subject to the terms and conditions stated herein, Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord certain premises consisting of the spaces designated as (a) Rooms 1099, 1099A, and 1100 of the Davis Building (the “Davis Building Premises”), (b) Rooms 143, 143A, and 143B of the SSB1 Building, and fifty percent (50%) of the usable square feet contained in Rooms 149 and 150 of the SSB1 Building (the SSB1 Building Premises) (the Davis Building Premises, together with the SSB1 Building Premises, the “Premises”). The “Premises Area” for such Premises shall mean and consist of 1,935 total rentable square feet, consisting of: (a) the sum of the total usable square feet within the Davis Building Premises described in Section 1.3.1 hereof and Tenant’s share of the space described in, and as determined pursuant to, Sections 1.3.3, plus (b) the sum of the total usable square feet within the SSB1 Building Premises described in Section 1.3.2 hereof and Tenant’s share of the space described in, and as determined pursuant to, Section 1.3.4 hereof. The floor plan for the Davis Building Premises is attached hereto as Exhibit B. The floor plan for the SSB1 Building Premises is attached hereto as Exhibit H. Tenant acknowledges that it has investigated the Premises prior to the execution hereof and agrees that the total rentable square footage of Premises Area for purposes of this Lease is not less than that set forth above and that Tenant shall be irrevocably bound by the designation of total rentable square footage of the Premises Area set forth above. For purposes of this Agreement, the “Common Services Space” shall mean those portions of the floors on which the Premises are located which are marked as such on Exhibit B and Exhibit H attached hereto.

| 5 |

2.2 With respect to that portion of the SSB1 Building Premises contained in Rooms 149 and 150 (“SSB1 149 and 150”), Tenant shall have the right to occupy that portion of SSB1 149 and 150 designated as exclusive space on Exhibit H attached hereto (the “SSB1 149 and 150 Exclusive Space”), on an exclusive basis and shall have the right to utilize the ducted hood located on the south wall of SSB1 149 and 150 on a non-exclusive basis. To ensure its exclusivity, Tenant shall have the right to install, subject to all appropriate Landlord consents and approvals as well as the provisions of Section 7.2, and so long as such barrier does not violate any fire laws, regulations or codes, a temporary barrier separating the SSB1 149 and 150 Exclusive Space from the remaining portion of SSB1 149 and 150. Subject to any reasonable conditions that Landlord may impose in its sole and absolute discretion, until such time that Landlord has a tenant to occupy the remaining portion of SSB1 149 and 150, Tenant shall have the right to utilize the remaining portion of SSB1 149 and 150.

2.3 This Lease and the Rent to be paid hereunder shall include any personal property, fixtures, equipment and/or other improvements of Landlord’s located within the Premises, but shall not include telephone equipment and usage charges, which shall be billed to Tenant separately by the Telecommunications Department.

ARTICLE

III

TERM; COMMENCEMENT DATE

The term of this Lease (“Original Lease”) shall commence on June 1, 2014. (“Commencement Date”) and end on May 31, 2017 (“Original Term Expiration Date”). The term of this Lease (“Term”) shall be three (3) years commencing with the Commencement Date, unless sooner terminated pursuant to the provisions hereof.

ARTICLE

IV

RENT

4.1 Basic Annual Rent.

4.1.1 Tenant shall pay to Landlord during the Term hereof basic annual rent in twelve equal monthly installments, each monthly installment equal to the product of (a) the total rentable square footage of the Premises Area, multiplied by (b) Eight Dollars ($8.00) per square foot per month, as adjusted from time to time pursuant to Section 4.2 hereof.

4.1.2 Notwithstanding the foregoing, the first six monthly installments payable by Tenant to Landlord during the Term hereof shall be equal to the product of (a) the total rentable square footage of the Premises Area, multiplied by (b) Five Dollars and Ninety Nine Cents ($5.99) per square foot per month.

| 6 |

4.1.3 The basic annual rent, as adjusted from time to time pursuant to Section 4.2 hereof, is referred to hereinafter as the “Basic Annual Rent”; provided, however, that for purposes of adjustments pursuant to Section 4.2 hereof, the Basic Annual Rent for the first adjustment on the first anniversary of the Commencement date shall be determined as though all twelve monthly installments payable by Tenant to Landlord during the first year of the Term hereof were based on the rate of Eight Dollars ($8.00) per square foot per month set forth in Section 4.1.1 and without regard to the lesser rate of Five Dollars and Ninety Nine Cents ($5.99) per square foot per month set forth in Section 4.1.2. Concurrently with the execution of this Lease, Tenant shall pay to Landlord the first monthly installment of Basic Annual Rent. Thereafter, each monthly installment of Basic Annual Rent, as adjusted from time to time pursuant to Section 4.2 hereof, shall be due and payable by Tenant to Landlord on the first day of each calendar month during the Term of the Lease.

4.2 Basic Annual Rent Increase.

4.2.1 On each anniversary (“Adjustment Date”) of the Commencement Date, commencing with the first anniversary of the Commencement Date, the Basic Annual Rent shall be increased by multiplying such Basic Annual Rent by a fraction, the numerator of which shall be the CPI (as hereinafter defined) for the calendar month in which the Adjustment Date falls, and the denominator of which shall be (a) the CPI for the calendar month of the Commencement Date in the case of the first adjustment on the first anniversary of the Commencement Date, and (b) in the case of all other adjustments, the CPI for the calendar month one year prior to the Adjustment Date for which the rental adjustment is then being calculated. (Such fraction shall never be less than one.) The sum so calculated or set shall constitute the new Basic Annual Rent hereunder, but, in no event, shall such new Basic Annual Rent be (i) less than the Basic Annual Rent payable for the annual period immediately preceding the Adjustment Date. For purposes hereof, “CPI” shall mean the United States Department of Labor Revised Consumer Price Index, Not Seasonally Adjusted, Los Angeles-Riverside-Orange County, CA metropolitan area (Base Period 1982/84 = 100) established monthly by the Bureau of Labor Statistics.

4.2.2 In the event the compilation and/or publication of the CPI shall be transferred to any other governmental department or bureau or agency or shall be discontinued, then the index most nearly the same as the CPI shall be used to make such calculations. In the event that Landlord and Tenant cannot agree on such alternative index, then the matter shall be submitted for decision to the American Arbitration Association in accordance with the then rules of such association and the decision of the arbitrators shall be binding upon the parties.

| 7 |

4.2.3 Tenant shall continue to pay the Basic Annual Rent at the rate previously in effect until the increase, if any, is determined. Within five (5) days following the date on which an increase is determined, Tenant shall make such payment to Landlord as will bring the increased rental current, commencing with the effective date of such increase through the date of any rental installments then due. Thereafter, the Basic Annual Rent shall be paid at the increased rate.

4.2.4 At such time as the amount of any change in Basic Annual Rent required by this Lease is known or determined, Landlord and Tenant shall execute a statement setting forth such change, but the enforceability of both this Lease and the increase in Basic Annual Rent shall not be affected should either party fail or refuse to execute such statement.

4.3 Additional Rent

4.3.1 Payment. In addition to the Basic Annual Rent, Tenant shall pay such additional rent and all other amounts or charges as may be required in this Lease. The Basic Annual Rent and said additional rent and other payments are sometimes collectively referred to herein as the “rent”. The rent shall be payable to Landlord, without demand, deduction or offset of any kind in lawful money of the United States of America at the address for Landlord set forth in this Lease or to such other person or at such other place as Landlord may from time to time designate in writing. If Tenant shall pay any rent with a check which is not a cashier’s check, the check shall be drawn against an account maintained in a bank or other financial institution which has a branch office located in Los Angeles, California.

4.3.2 Taxes and Capital Improvements.

(a) Definitions. For purposes of this Section 4.3.2 and this Lease:

(i) “Operating Expenses” shall mean the total of all actual costs, expenses, and disbursements for or in connection with the operation, management, maintenance, protection, remediation, servicing or repair of the Project (or any portion thereof). Operating Expenses shall include: (1) the cost of providing, managing, operating, maintaining and repairing air-conditioning, electricity, steam, heating, mechanical, ventilation, escalator and elevator systems and all other utilities generally supplied to all tenants and the cost of supplies and equipment and maintenance and service contracts in connection therewith; (2) the cost of repairs, general maintenance, cleaning, trash removal, telephone service, security service and janitorial service, light bulb and tube replacement and supplies; (3) the cost of fire, extended coverage, boiler, sprinkler, apparatus, public liability, property damage, rent, earthquake and other insurance; (4) wages, salaries and other labor costs including taxes, insurance, retirement, medical and other employee benefits; (5) fees, charges and other costs, including management fees, consulting fees, legal fees and accounting fees, of all independent contractors engaged by Landlord or charged by Landlord if Landlord performs such services in connection with the Project; (6) the fair market rental value of any offices in the Buildings (or in other buildings on the Landlord’s campus) used for management of the Project; (7) the cost of business licenses and similar taxes; (8) fees imposed by any federal, state or local government for fire and police protection, trash removal or other similar service; (9) any charges which are payable by Landlord pursuant to any type of service agreement or a functional equivalent with the City of Los Angeles or for other services supplied to the Project by the City of Los Angeles under any type of a special assessment district, and not included as Real Property Taxes; and (10) any other expenses of any kind whatsoever incurred for managing, operating, protecting, remediating, maintaining and repairing the Project. Operating Expenses shall be adjusted to reflect ninety-five percent (95%) occupancy of the Project during any period in which the Project is not fully occupied. Operating Expenses which are incurred for the benefit of the Project and other properties owned by Landlord shall be reasonably allocated by Landlord between the Project and such other properties.

| 8 |

(ii) “Real Property Taxes” shall mean all taxes, assessments (special or otherwise) and charges levied upon or with respect to the Project (or any portion thereof) and ad valorem taxes on personal property owned or used by Landlord in connection therewith, but excluding taxes on personal property owned or used by Landlord to the extent that such personal property is used by Landlord in its capacity as an occupant of the Buildings. Real Property Taxes shall include, without limitation, any tax, fee or excise on the act of entering into this Lease, on the occupancy of Tenant, or the rent hereunder which are now or hereafter levied, assessed or imposed against Landlord by the United States of America, the State of California or any political subdivision, public corporation, district or other political subdivision, or public entity, and shall also include any other tax, assessment, fee or excise, however described (whether general or special, ordinary or extraordinary, foreseen or unforeseen), which may be levied, assessed or imposed in lieu of, as a substitute, in whole or in part, for or as an addition to, any other Real Property Taxes. Landlord shall pay any such special assessments in installments when allowed by law, in which case Real Property Taxes shall include any interest charged thereon, or, if Landlord chooses to pay such Real Property Taxes in a lump sum payment, Landlord shall allocate such Real Property Taxes (together with a factor for interest thereon at the rate such interest would have accrued had Landlord elected to pay such special assessments on an installment basis) to Tenant as if Landlord had paid such Real Property Taxes on an installment basis. Real Property Taxes shall not include income, franchise, transfer, gift, inheritance, estate or capital stock taxes, unless due to a change in the method of taxation, any of such taxes are levied, assessed or imposed against Landlord in lieu of, as a substitute, in whole or in part, for any other tax which would otherwise constitute a Real Property Tax, but then only to the extent thereof. Real Property Taxes shall also include legal fees, costs and disbursements incurred in connection with proceedings to contest, determine or reduce Real Property Taxes.

| 9 |

(iii) “Cost Saving Capital Improvement(s)” shall mean any equipment, device or other improvement incorporated into the Buildings or other portion of the Project, which capital improvement achieves economies in Operating Expenses, taking into account all applicable costs, in the operation, maintenance and repair of the Buildings or such relevant portion of the Project.

(iv) “Government Mandated Capital Improvement(s)” shall mean any equipment, device or other improvement acquired and installed in the Buildings or other portion of the Project, to comply with any governmental requirement with respect to the Buildings or any portion of the Project, including without limitation, fire, health, safety or construction requirements, if the cost thereof should be capitalized in accordance with generally accepted accounting principles. Government Mandated Capital Improvement(s) and Cost Saving Capital Improvement(s) are sometimes herein referred to as -Capital Improvement(s).”

(v) “Capital Improvement Amortization” shall mean the amount determined by multiplying the actual cost, including financing costs if any, of each Capital Improvement acquired, installed or placed in service by Landlord by the constant annual percentage required to fully amortize such cost over the useful life of the Capital Improvement (as reasonably estimated by Landlord at the time of acquisition, installation, or placement in service). The Capital Improvement Amortization shall be allocated and charged to Tenant as an amount per square foot of rentable area consistently applied.

(b) Adjustments to Rent - Operating Expenses and Real Property Taxes. Operating Expenses shall be charged monthly to Tenant as additional rent as follows: (i) at an amount (“Premises Operating Expenses”) equal to (A) total rentable square footage of the Premises Area, multiplied by (B) two dollars ($2.00) (“Base Operating Expense”) per square foot per month (described in Exhibit C hereto), as adjusted from time to time as follows: on each anniversary (“Adjustment Date”) of the Commencement Date, the Base Operating Expense shall be increased by multiplying such Base Operating Expense, by a fraction, the numerator of which shall be the CPI (as defined in Section 4.2.1 hereof) for the calendar month in which the Adjustment Date falls, and the denominator of which shall be (a) the CPI for the calendar month of the Commencement Date in the case of the first adjustment on the first anniversary of the Commencement Date, and (b) in the case of all other adjustments, the CPI for the calendar month one year prior to the Adjustment Date for which the rental adjustment is then being calculated (such fraction shall never be less than one); the adjusted amount so calculated or set shall constitute the new Base Operating Expense hereunder, but, in no event, shall such new Base Operating Expense be less than the Base Operating Expense payable for the monthly period immediately preceding the Adjustment Date. In any calendar year, the sum of the Premises Operating Expenses, Tenant’s Pro Rata Share (as defined below) of all costs and other expenses described in Article XXX for the Project, and Tenant’s share of Real Property Taxes and other property taxes as determined in accordance with Section 4.3.2(d) hereof and the other provisions of this Lease, shall equal the combined expenses for all twelve months of such calendar year (“Combined Expenses”). In each calendar year during the Term of this Lease (including the partial year commencing on the Commencement Date of this Lease), the rent payable by Tenant for such calendar year shall be increased over the Basic Annual Rent, as adjusted in accordance with Section 4.2, by the amount of the Combined Expenses for such calendar year. In addition to the foregoing, any costs or expenses for services or utilities in excess of those required by this Lease to be supplied by Landlord and which are attributable directly to Tenant’s use or occupancy of the Premises shall be paid in full by Tenant as additional rent when such costs are incurred, or, if Landlord makes such payments, within fifteen (15) days after being billed therefor by Landlord. As used in this Lease, the terms “square feet,” “square foot” and “square footage” shall be based on rentable square feet as determined using the Building Owners and Managers Association’s Standard Method For Measuring Floor Area In Office Buildings (ANSI/BOMA 265.1-1996) (“BOMA Standards”), unless otherwise specifically provided herein. For purposes hereof, “Tenant’s Pro Rata Share” shall mean a fraction, the numerator of which is the rentable square feet of the Premises Area and the denominator of which is the rentable square feet of space within the Buildings.

| 10 |

(c) Adjustments to Rent for Capital Improvements. In any Lease Year, or portion thereof, during the Term of this Lease which is included in the useful life of a Capital Improvement, the rent payable by Tenant for such year, or portion thereof, shall be increased over the Basic Annual Rent, as adjusted in accordance with Section 4.2 and Section 4.3.2(b), by the amount of the Capital Improvement Amortization per square foot of rentable area of the Buildings, multiplied by the Premises Area.

(d) Additional Taxes and/or Improvements. Notwithstanding anything contained in this Lease to the contrary, any Real Property Taxes, other property taxes, and/or Government Mandated Capital Improvements which are attributable to Tenant’s use or occupancy of the Premises shall be paid in full by Tenant as additional rent. The parties hereto acknowledge that the portion of the Buildings occupied or used by Landlord have been determined to be tax exempt and that the portion of the Buildings occupied by Tenant and other tenants or occupants may be found to be subject to Real Property Taxes and other property taxes because Tenant and other tenants and occupants do not constitute tax-exempt organizations under Section 503(c) of the Internal Revenue Code, as amended, or because the premises area used by such tenants and occupants are found not to be used for tax exempt purposes or for other reasons. Consequently, the parties hereto agree that Real Property Taxes assessed against the Project (or any portion thereof) or Buildings (or any portion thereof) shall be attributed entirely to the premises area occupied or used by such taxable organizations and by organizations using their premises area for purposes which are not tax exempt. Landlord shall have the right to allocate such Real Property Taxes among Tenant and the other tenants and occupants in a reasonably equitable manner. For these purposes, allocating such Real Property Taxes in the following manner shall be deemed reasonably equitable: multiply the Real Property Taxes by a fraction, the numerator of which is the Premises Area of the Tenant, and the denominator of which is the rentable square feet of premises area used or occupied by tenants and other occupants for purposes which are not tax exempt or which are not tax exempt for any other reason.

| 11 |

(e) Landlord’s Statement. Prior to the commencement of each calendar year (including the partial year commencing on the Commencement Date of this Lease), or as soon thereafter as possible, Landlord shall furnish to Tenant a statement (“Landlord’s Statement”) of Landlord’s estimate of the Real Property Taxes and Capital Improvement Amortization expected to be incurred during the calendar year, based on the amount of such Real Property Taxes and Capital Improvement Amortization in the prior calendar year (if any), adjusted for known changes which have or will occur in the Project, the rates charged by suppliers, or other circumstances affecting the amount of such Real Property Taxes or Capital Improvement Amortization during the calendar year in question, and showing the amount, if any, payable by Tenant as additional rent for such calendar year, or portion thereof, pursuant to Sections 4.3.2(b), 4.3.2(c), 4.3.2(d) and any other applicable provisions of this Lease, on the basis of such estimate. Commencing as of January 1st of each calendar year, Tenant shall pay to Landlord one-twelfth (1/12) of the amount of the additional rent estimated for Real Property Taxes and Capital Improvement Amortization, along with the monthly charge for Premises Operating Expenses, on each monthly rent payment date until further adjustment pursuant to this Section 4.3.2. If the Term of the Lease with respect to any space commences or terminates at any time other than the first day of the calendar year, then during such partial calendar year, Tenant shall pay to Landlord, on each of the monthly payment dates during said partial calendar year, the amount of said estimated additional rent with respect to such space, attributable solely to such partial calendar year divided by the number of months in said partial calendar year. If Landlord’s Statement is furnished after January 1st of a calendar year, Tenant shall pay the entire portion of the estimated additional rent attributable to portions of the calendar year prior to Tenant’s receipt of Landlord’s Statement on the later of fifteen (15) days, or the first monthly rent payment date, after Tenant’s receipt of Landlord’s Statement. Landlord shall have the right, in Landlord’s discretion, to revise Landlord’s estimates during the calendar year to reflect the then current Real Property Taxes and Capital Improvement Amortization, and Landlord shall issue a revised Landlord’s Statement. Tenant’s monthly rent payments shall be further adjusted in accordance with the revised Landlord’s Statement commencing on the first monthly rent payment date following Tenant’s receipt from Landlord of the revised Landlord’s Statement. With reasonable promptness after the expiration of each calendar year, but in any event within one hundred twenty (120) days after the expiration of such calendar year, Landlord shall furnish to Tenant a year-end statement showing: (i) the actual Real Property Taxes and Capital Improvement Amortization during the previous calendar year, which such amounts in each such category and the proper allocation thereof to the Project shall be certified by Landlord and the allocation thereof to Tenant shall be certified by Landlord to be proper and in accordance with this Lease; (ii) the difference, if any, between Landlord’s Statement and the actual amounts; and (iii) the aggregate amount of any charge or credit to Tenant necessary to adjust rent previously paid by Tenant to the actual Real Property Taxes and Capital Improvement Amortization. Promptly after the receipt of said statement by Tenant, Tenant shall, in case of any underpayment, pay Landlord in accordance with Section 4.3.1, or in case of an overpayment, Tenant shall receive a credit against rents subsequently payable to Landlord.

| 12 |

4.3.3 Charges for Use of Specialized Research Cores. In addition to Basic Annual Rent, Tenant shall be charged for any use by Tenant of Specialized Research Cores (as defined in Section 9.2 hereof) or any services rendered from such Specialized Research Cores (or both) at rates established by Landlord, in its sole discretion, from time to time. Tenant understands that the rates charged for such use or services (or both) are subject to change from time to time. Services rendered by or through Landlord from the Specialized Research Cores are more specifically described in Section 28.6 hereof.

4.4 Definitions. As used in this Lease, the following terms shall have the following meanings:

4.4.1 Lease Years; Calendar Years. “Lease Years” shall mean the consecutive twelve (12) month periods commencing with the Commencement Date or, if the Commencement Date falls other than on the first day of a calendar month, then commencing the first day of the first calendar month following the Commencement Date. The fraction of the month (if any) following the Commencement Date and prior to the commencement of the first Lease Year shall be deemed to be part of the first Lease Year. If Landlord employs fiscal years not constituting calendar years, the term “calendar years” shall be deemed, at Landlord’s election, to mean the consecutive twelve (12) month periods comprising Landlord’s fiscal years.

4.4.2 Lease Rate. “Lease Rate” shall mean an annual interest rate which is the lesser of: (a) the maximum rate permitted by law, if applicable; or (b) the rate of interest from time to time announced by Union Bank at its corporate headquarters in Los Angeles, California, as its prime rate of interest, plus two (2) percentage points, or, should Union Bank cease or fail to announce a prime rate, then the rate announced from time to time by Bank of America NT & SA at its corporate headquarters in San Francisco, California, as its reference rate, plus two (2) percentage points. Should both Union Bank and Bank of America NT & SA cease or fail to announce such rates, the rate shall be agreed upon by the parties or, if they cannot agree, the rate shall be determined by arbitration pursuant to the American Arbitration Association in accordance with the then rules of such association and the decision of the arbitrator shall be binding upon the parties.

| 13 |

4.5 Miscellaneous Rent Provisions.

4.5.1 Prorations. If the Term of this Lease commences, or the date of expiration of this Lease occurs, other than on the first day or last day of a calendar month, the Basic Annual Rent for such month shall be prorated on the basis of a thirty (30) day month.

4.5.2 Place and Manner of Payment. Basic Annual Rent shall be payable in advance in twelve (12) equal monthly installments, with the first such monthly payment of Basic Annual Rent due on the Commencement Date (prorated if such date occurs on other than the first day of the month), and all other monthly payments to be due on the first day of each calendar month during the Term hereof. All such payments are to be forwarded by Tenant to the respective offices of the Buildings, or to such other person or at such other place as directed from time to time by written notice from Landlord, in lawful money of the United States of America, without demand, deduction, offset or abatement, except as may otherwise be specifically provided in this Lease.

4.5.3 Conditional Payment. No payment by Tenant or receipt by Landlord of a lesser amount than the total of all sums due hereunder shall be deemed other than on account of the earliest stipulated rent, nor shall any endorsement or statement on any check, or any letter accompanying any check or payment as rent, be deemed an accord or satisfaction, and Landlord may accept such cash and/or negotiate such check or payment without prejudice to Landlord’s right to recover the balance of such rent, or Landlord may pursue any of its other remedies provided in this Lease or otherwise, regardless of whether Landlord makes any notation on such instrument of payment or otherwise notifies Tenant that such acceptance, cashing or negotiation is without prejudice to Landlord’s rights.

4.6 Security Deposit. Landlord and Tenant acknowledge and agree that pursuant to the Expired Lease, Tenant has on deposit with Landlord the sum of Nine Thousand One Hundred Eight Dollars ($9,108.00) as a security deposit. Concurrently with the execution and delivery of this Lease, Tenant shall deposit the additional sum of Twenty Nine Thousand Five Hundred Ninety Two Dollars ($29,592.00) with Landlord, bringing the total amount of the Security Deposit to Thirty Eight Thousand Seven Hundred Dollars ($38,700.00) as security for the full and faithful performance of every provision of this Lease to be performed by Tenant. If Tenant defaults with respect to any provision of this Lease, including, but not limited to, the provisions relating to the payment of rent set forth in this Lease, Landlord may use, apply or retain all or any part of the Security Deposit for the payment of such rent, fees or any other sum in default, or for the payment of any other amount which Landlord may reasonably spend or become obligated to spend by reason of Tenant’s default, or to compensate Landlord for any other loss or damage which Landlord may reasonably suffer by reason of Tenant’s breach of the terms of this Lease, or to pay Landlord for any amount due under any indemnification provision contained in this Lease. If any portion of the Security Deposit is so used or applied, Tenant shall within five (5) days of receipt of notice thereof from Landlord, deposit cash with Landlord in an amount sufficient to restore the Security Deposit to its original amount and Tenant’s failure to do so shall be a material breach of this Lease. Landlord shall not be required to keep the Security Deposit separate from its general funds, and Tenant shall not be entitled to interest on such deposit.

| 14 |

ARTICLE

V

TAXES ON TENANT’S PROPERTY

With respect to all of Tenant’s trade fixtures, equipment and personal property (collectively, “Tenant’s Property”) located within the Premises: (i) Tenant shall pay prior to delinquency all taxes assessed against or levied thereon; and (ii) when reasonably possible, Tenant shall cause such property to be assessed and billed separately from the property of Landlord; but if Tenant’s Property shall be assessed and taxed with the property of Landlord, Tenant shall pay to Landlord its share of such taxes within ten (10) days after receipt by Tenant of a statement in writing setting forth the amount of such taxes applicable to Tenant’s Property, which statement shall include the basis on which such share of taxes was allocated to Tenant. Tenant shall have the right to contest, in good faith and by appropriate and timely legal proceedings, the legality, assessed valuation or amount of any tax or assessment which Tenant is required to pay pursuant to the Lease. Landlord shall reasonably cooperate with the Tenant in the prosecution of such contest, provided that all expenses incurred by Landlord for or in connection with such cooperation (including, without limitation, all attorney’s fees, appeals board, court and other costs) are paid solely by Tenant. If Landlord is required to pay the taxing authority any tax or assessment which Tenant desires to contest, Tenant shall, pending resolution of the contest by the taxing authority and as a condition of its right to contest the tax assessment, pay the tax or assessment under protest, but otherwise as provided in the Lease.

| 15 |

ARTICLE

VI

USE OF PREMISES

6.1 Limitation of Use. Tenant shall use and occupy the Premises only for activities (“Company Activities”) arising from, or relating to, reasonable corporate activities, including office, administrative, fundraising activities, and research and development, including biomedical or biochemical processes and methods, including research, development and production of biomedical reagents, agents, devices, cell lines, and other chemical, biomedical, or biochemical products or devices (“Permitted Uses”), as more particularly described in Exhibit D attached hereto. Tenant shall not use or occupy the Premises or permit the same to be used or occupied for patient care activities, to conduct clinical trials or for any other purposes without the prior written approval of Landlord, which approval shall be in Landlord’s sole and absolute discretion. Tenant shall control access to the Premises, and to any Specialized Research Core used by Tenant, by issuing identification badges and access cards to each of Tenant’s employees, who shall be required to carry such identification badges and access cards at all times that they are present in the Premises or any other part of the Buildings. Tenant shall not do or permit anything to be done which will in any way obstruct or interfere with the rights of other tenants or occupants of the Buildings or injure or annoy them, nor use or allow the Premises to be used for any improper, immoral, or unlawful or reasonably objectionable purpose, nor shall Tenant cause or maintain or permit any nuisance in, or about the Premises, nor shall Tenant cause or permit any hazardous or toxic waste, substance or material to be brought to the Premises or used, handled, stored or disposed of in or about the Premises, except as otherwise permitted by law and typically used in the conduct of the Biomedical Activities which are conducted from the Premises in accordance with this Lease and then only in accordance with the provisions of any rules and regulations established by Landlord from time to time concerning such use. Tenant shall provide the Director of Radiation Safety of Landlord (or such other person as Landlord shall direct from time to time) with a list of all Hazardous Materials (as defined in Article XXX hereof) which it is using or which it intends or expects to use in the Premises, an explanation of the purpose for each listed item, and the means and methods for each listed item’s disposal in compliance with all applicable laws. Tenant shall promptly revise and supply Landlord with a new list of Hazardous Materials whenever the existing list on file is no longer complete and accurate in all respects. Tenant shall not conduct business or other activity in, on or about the Premises of such a nature as to place an unreasonable and excessive burden upon the public and Common Areas of the Project. Tenant shall not commit or suffer the commission of any waste in, on or about the Premises. In connection with all of the foregoing, Tenant, at its sole cost and expense and subject to compliance with all applicable provisions of this Lease, shall install and maintain: (i) such improvements and equipment as shall be reasonably necessary to prevent the use or operation of equipment located in the Premises or the conduct of Tenant’s practice in the Premises from affecting others in the Buildings or their equipment; and (ii) such additional floor load support as shall be reasonably necessary to accommodate equipment to be located in the Premises. Nothing contained in this Lease shall limit Landlord’s right to use, or to lease other portions of, the Project for any purpose or use that Landlord deems appropriate, and nothing contained herein shall be deemed to grant to Tenant any right to prevent Landlord, or to require Landlord to preclude others in the Project, from using space anywhere in the Project for the same or similar uses or purposes for which Tenant uses the Premises.

| 16 |

6.2 Compliance with Governmental and Insurance Regulations. Tenant shall not use or occupy the Premises in violation of the Certificates of Occupancy of the Buildings or the Premises or of any law, ordinance or regulation or other directive of any governmental authority having or exercising jurisdiction over the Buildings or Project, whether now in effect or becoming effective subsequent to the date hereof (collectively, “Applicable Laws”). Tenant may, in good faith, contest the validity or application of any law, statute, ordinance, governmental rule or regulation, provided Landlord is not thereby subject to any liability and provided Landlord shall not anticipate suffering adverse consequences or monetary or other damage as a result of such contest or as a result of the outcome of such contest. Upon five (5) days’ written notice from Landlord, Tenant shall discontinue any use of the Premises which is declared by any governmental authority having or exercising jurisdiction to be a violation of the Certificate of Occupancy of the Buildings or the Premises or any Applicable Laws. Tenant shall not do or permit to be done anything which will invalidate or cause termination of or increase the cost of any fire and extended coverage or other insurance policy covering the Buildings, the Project or the Property. Within five (5) days of its receipt of written notice, Tenant shall reimburse Landlord for any additional premium charges for such policy or policies caused by reason of Tenant’s failure to comply with the provisions of this Section. Tenant shall keep the Premises, and every part thereof, in a clean, sanitary and wholesome condition, free from any objectionable noises, odors or nuisances, public or private, and Tenant shall comply, at its own expense, with all health and policy regulations. Tenant shall comply with all laws, rules, orders, ordinances, directions, regulations and requirements of federal, state, county and municipal authorities pertaining to Tenant’s use of the Premises, and with any direction of any public officer or officers, pursuant to law, which shall impose any duty upon Landlord or Tenant with respect to the use or occupation of the Premises.

6.3 Assumption of Risk of Noncompliance. Tenant hereby warrants that, as of the execution of this Lease, it has investigated whether its proposed use of the Premises and its proposed manner of operation will comply with all Applicable Laws, and Tenant assumes the risk that its proposed use of the Premises and its proposed manner of operation are and will continue to be in compliance with all Applicable Laws, including, without limitation, all zoning laws regulating the use and enjoyment of the Premises. Tenant agrees that under no circumstances will Tenant be released, in whole or in part, from any of its obligations under this Lease as a result of any governmental authority disallowing or limiting Tenant’s proposed use of the Premises or its manner of operation. Additionally, subject to Article VII below, Tenant shall install, at its own expense, any improvements, changes or Alterations in the Premises authorized in writing by Landlord which are required by any governmental authority as a result of Tenant’s specific use of the Premises or its manner of operation thereunder. If Landlord performs such Alterations because of Tenant’s failure to perform the same, Tenant shall promptly reimburse Landlord for the actual costs of such Alterations.

6.4 Safety Training Program. Prior to participating in any of the Biomedical Activities permitted under this Lease, each of Tenant’s employees shall be required to participate in an orientation and safety training program established by Landlord, which program shall address environmental safety issues, including, but not limited to, the proper handling of radioactive, chemical and other Hazardous Materials.

6.5 Use of Common Services Space. Tenant shall have the right to use the Common Services Space in connection with and ancillary to its use of the Premises, in common with other tenants and occupants of the Buildings, subject to such rules and regulations as Landlord may impose from time to time. The Common Services Space as of the date of this Lease is graphically depicted on Exhibit B and Exhibit H hereto.

| 17 |

6.6 Animal Research. If Tenant uses animals for or in connection with research on or about the Premises or the Buildings, such animals must be acquired or obtained solely through Landlord. Tenant acknowledges that a breach of this Section 6.6 could result in irreparable harm to Landlord and will cause Landlord to incur substantial damages. Therefore, notwithstanding anything contained in this Lease to the contrary, any breach of this Section 6.6 shall be deemed to be an incurable breach which shall automatically entitle the Landlord, in addition to all other remedies to which Landlord is or may be entitled under this Lease, or at law, or in equity, to terminate this Lease.

ARTICLE

VII

CONSTRUCTION AND MAINTENANCE OF PREMISES

AFTER INITIAL CONSTRUCTION

7.1 Maintenance of Premises. Following the Commencement Date and except as otherwise provided in Section 7.4 below, Tenant shall, at its own cost and expense, keep and maintain, in good, sanitary, and tenantable condition and repair, the Premises and every part thereof including, without limitation, the floor covering, all interior walls, ceilings, doors, decorations (e.g., carpeting, painting, wall covering and refinishing), fixtures and equipment therein. Landlord may make any reasonable repairs which are not made by Tenant with reasonable diligence after notice from Landlord and charge Tenant for the actual cost thereof Tenant shall take precautions to prevent, shall prevent, and shall promptly eradicate from the Premises or any other portion of the Buildings or Project any infestations which arise from Tenant’s use of the Premises, including, without limitation, rodents and insects.

7.2 Tenant Construction.

7.2.1 Landlord’s Consent. Tenant shall not make any alterations, additions, modifications or improvements (collectively, “Alterations”) to the Premises, the Buildings or any part thereof without Landlord’s advance written consent, nor, in any event, Alterations which interfere with or disrupt other tenants or occupants in the Buildings or with Landlord’s work, if any, then being carried out therein. Landlord shall not unreasonably withhold its consent to any Alterations, additions or improvements to the Premises or any part thereof which do not involve structural changes to the Buildings, do not affect the external appearance of the Buildings, and do not affect or involve modifications to the Buildings’ systems such as HVAC, electrical systems, floor load capacities, plumbing and other utility systems. Landlord will grant its approval or disapproval of any proposed alteration, addition or improvements within thirty (30) business days after receipt from Tenant of the necessary plans and specifications and other information reasonably necessary to make a decision with respect thereto or reasonably relevant to such Landlord’s decision, and failure by Landlord to disapprove such proposed alteration, addition or improvement within such thirty (30) business days shall be deemed approval thereof. To the extent permitted or consented to hereunder, any construction undertaken by Tenant in or to the Premises or the Buildings shall comply with all the terms and provisions of Sections 7.2.2 and 7.2.3 below.

| 18 |

7.2.2 Licensed Contractors. Tenant shall utilize only bondable licensed contractors for any proposed Alterations. Tenant shall prepare, obtain and promptly provide Landlord with copies of bid solicitations and bids received for all such work.

7.2.3 Construction Requirements. Subject to the other provisions hereof, any Alterations installed by Tenant, its contractor or agents at any time subsequent to the Commencement Date, and including, without limitation, any construction performed by Tenant, shall be done only in compliance with the following:

(a) No such work shall proceed without Landlord’s prior written approval of: (i) Tenant’s contractor and Tenant’s architect or space planner; (ii) certificates of insurance; (iii) detailed plans and specifications for such work; performance and labor and materials payment bonds; and (v) all governmental permits.

(b) Any work not acceptable to any governmental authority or agency having or exercising jurisdiction over such work, or not satisfactory to Landlord, shall be promptly replaced at Tenant’s expense. Notwithstanding any failure by Landlord to object to any such work, Landlord shall have no responsibility therefor.

(c) All work by Tenant or its contractors shall be scheduled through Landlord.

(d) Tenant shall promptly reimburse Landlord for any extra expense incurred by Landlord by reason of faulty work done by Tenant or its contractors, or by reason of inadequate cleanup.

| 19 |

(e) Tenant or any contractor of Tenant shall not use non-union labor if such use would result in any unreasonable or unusual interference with or disturbance of the operations of Landlord or Landlord’s labor relationships. Neither Tenant nor any contractor of Tenant shall use non-union labor if such use would constitute a violation of any applicable master or other labor agreement which is or becomes binding or applicable to Landlord now or in the future. Tenant shall assume the risk of any strikes or labor disturbances arising out of the use of non-union labor, and any delays arising out of such strikes or disturbances shall not excuse or postpone the time for any performance or obligation of Tenant under this Lease or related agreements, notwithstanding the applicability of any force majeure clause or other provision contained in this Lease or related agreements.

(f) If required for either or both Buildings’ safety in Landlord’s discretionary judgment, all x-ray, laser, other medical equipment, data processing, photocopying, copying, and other special electrical equipment shall have a separate duplex outlet and shall be installed only under the supervision of Landlord or its electrical contractor. Tenant shall pay any additional costs on account of any increased support to the floor load necessary therefor or for any other equipment or improvements which Landlord reasonably deems necessary for the proper and safe installation of any such equipment.

(g) Before the commencement of any construction by Tenant in, on or around the Premises or the Buildings, Tenant or its contractors shall give advance written notice thereof to Landlord or its agent sufficient for Landlord’s preparation, posting and recordation of an appropriate notice of non-responsibility as provided in California Civil Code § 3094 or any related, successor or similar provision of law. Within ten (10) days after completion of any work in, to or about the Premises or the Buildings, Tenant or its contractor shall file for record in the Office of the Los Angeles County Recorder a notice of completion as permitted by law.

(h) Tenant acknowledges that Landlord’s approval of Tenant’s plans and specifications for any work to be performed in or to the Premises (including, without limitation, any mechanical, electrical, architectural or structural Alterations) shall not constitute a representation or warranty by Landlord as to the adequacy of such plans and specifications respecting Tenant’s intended use of the Premises (including, without limitation, electrical energy conservation) or as to the compliance of such plans and specifications (or the work performed pursuant thereto) with the laws, regulations and ordinances of any governmental authority or agency having or exercising jurisdiction over such work. Landlord expressly disclaims any liability or responsibility for such plans and specifications and the work performed pursuant thereto and Tenant expressly agrees that Landlord shall not be responsible therefor, and Tenant shall indemnify and hold Landlord harmless from any damage or injuries (including, without limitation, reasonable attorneys’ fees) resulting from errors or omissions in such plans and specifications.

(i) Upon completion of such work, Tenant shall deliver to Landlord a set of as-built drawings and all CADD work (on disks) relating to the work.

| 20 |

7.3 Condition of Premises. Tenant acknowledges that neither Landlord nor any agent of Landlord has made any representation or warranty with respect to the Buildings or the Premises or with respect to the suitability of either for the conduct of Tenant’s business. The taking of possession of the Premises by Tenant shall conclusively establish that the Premises and the Buildings were at such time in good and sanitary order, condition and repair.

7.4 Landlord Repairs and Maintenance After Commencement Date. Subject to the provisions of Section 7.1 above and performance of Tenant’s obligations under this Lease, including, without limitation, those set forth in Section 4.3 hereof, following the Commencement Date, Landlord shall: (i) keep in good order, condition and repair the foundations, exterior walls, downspouts, gutters and roof of the Buildings and the plumbing and sewage system outside the Buildings; (ii) make structural repairs to the Premises necessitated by defective, faulty, or negligent design or construction; (iii) repair and maintain the mechanical systems necessary to provide those utilities and Buildings’ services to the Premises which Landlord has specifically agreed to provide pursuant to Article XXVIII below, and maintain the light fixtures and unexposed electrical, plumbing and sewage systems in the Premises and the heating, ventilating and air conditioning systems in the Premises. Notwithstanding the foregoing, Landlord shall not be obligated to repair any damage to the Buildings or the Premises caused by any act or negligence of Tenant or its employees, agents, invitees, permittees, licensees or contractors. Landlord shall not be obligated to make any such repairs until after the expiration of fifteen (15) days” written notice from Tenant to Landlord, stating the need for such repairs or maintenance. Landlord shall not be called upon or required at any time to make any repairs, maintenance, improvements, alterations, changes, additions, repairs or replacements of any nature whatsoever in or to the Premises or the Buildings except as specifically provided in this Lease. To the maximum extent permitted by law, Tenant hereby waives the provisions of any statute or law permitting a tenant to make repairs at the expense of a landlord or to terminate a lease by reason of the condition of the Premises, including the provisions of California Civil Code Sections 1941 and 1942 and any similar, successor or related provision of law.

ARTICLE

VIII

MECHANICS’ LIENS

Tenant agrees to pay promptly for all costs and charges for all labor done or materials furnished for any work of repair, maintenance, improvement, alteration or addition, including, without limitation, installation of fixtures, done or caused to be done by Tenant in connection with the Premises, and Tenant hereby indemnifies and agrees to hold Landlord and the Premises free, clear and harmless from and against all liens and claims of liens, and all other liabilities, claims and demands (including, without limitation, reasonable attorneys’ fees), that arise by reason of such work. If any such lien shall at any time be filed against the Premises, or any portion of the Buildings, Tenant shall either cause the same to be discharged of record within twenty (20) days after the date upon which the same is filed or, if Tenant in its discretion and in good faith determines that such lien should be contested, Tenant shall record, in the office of the county recorder in which such claim of lien was recorded, a bond executed by a corporation authorized to issue surety bonds in the State of California, in a penal sum equal to one and one-half (1 1/2) times the amount of the claim or one and one-half (1 1/2) times the amount allocated to the Premises (and/or to other portions of the Buildings, Project, or Property) to prevent any foreclosure proceedings against the Premises (and/or other portions of the Buildings, Project, or Property) during the pendency of such contest. Such bond shall be conditioned for the payment of any sum which the claimant may recover on the claim together with the claimant’s costs of suit in the action, if the claimant recovers therein. Nothing contained herein shall imply any consent or agreement on the part of Landlord to subject Landlord’s interest in the real property of which the Premises are a part to liability under any mechanics’ or other lien law. Should Tenant receive notice that a claim of lien has been or is about to be filed against the Premises, the Buildings, Property or Project or that any action affecting the title to such property has commenced or is about to commence, Tenant shall immediately transmit such notice and information to Landlord.

| 21 |

ARTICLE

IX

COMMON AREAS AND SPECIALIZED RESEARCH CORES

9.1 Common Areas. The term “Common Areas” as used in this Lease shall mean all areas and facilities around the Premises and within the exterior boundaries of the Property which are provided and designated from time to time by Landlord for the general use and convenience of Tenant and other tenants or occupants of the Buildings and their respective employees, invitees or other visitors. Common Areas include, without limitation, the Common Services Space, the lobby area, walkways, parking facilities, landscaped areas, sidewalks, service quarters, hallways. restrooms (if not part of the Premises), stairways, elevators, walls, fire stairs, telephone and electric closets, truck docks, plazas, service areas, lobbies, darkroom, pantry, small conference room, glass wash room, equipment corridor, walk-in cold room, and all other common and service areas of the Property and Buildings or any other area of the Project intended for such use, other than Specialized Research Cores (defined in Section 9.2 hereof). Floors wholly occupied by Tenant shall not have any facilities which would be used in common with other tenants, except for fire stairs, shafts and similar installations. Tenant, its employees and invitees shall have the nonexclusive right to use the Common Areas along with others entitled to use the same, subject to Landlord’s rights and duties as hereinafter set forth. Without advance notice to Tenant or consent of Tenant and without any liability to Tenant in any respect, Landlord shall have the right to:

(a) establish and enforce reasonable rules and regulations concerning the maintenance, management, use and operation of the Common Areas;

| 22 |

(b) close off any of the Common Areas to whatever extent required in the reasonable opinion of Landlord and its counsel to prevent a dedication of any of the Common Areas or the accrual of any rights by any person or the public to the Common Areas;

(c) temporarily close any of the Common Areas for maintenance, alteration or improvement purposes;

(d) select, appoint and/or contract with any person for the purpose of operating and maintaining the Common Areas; and

(e) change the size, use, shape or nature of any of the Common Areas.

Landlord shall use its reasonable efforts to minimize interference with Tenant’s use of and access to the Premises when exercising Landlord’s rights with respect to the Common Areas set forth in this Article IX.

9.2 Specialized Research Cores. The term “Specialized Research Cores” as used in this Lease shall mean all areas and facilities around the Premises and within the exterior boundaries of the Property which are provided and designated from time to time by Landlord for special use by Tenant and other tenants or occupants of the Buildings and their respective employees. Specialized Research Cores include, without limitation, animal housing facilities, animal surgical core, confocal microscopy facility, sequencing core, and cell sorter core.

| 23 |

ARTICLE

X

LANDLORD’S RIGHT OF ACCESS

Landlord reserves for itself and its agents the right to enter the Premises (after advance notice except in emergencies and except to perform janitorial services) for purposes reasonably related to Landlord’s operation of the Buildings, including, without limitation: (i) examining or inspecting the same; (ii) providing janitorial and any other service to be provided by Landlord to Tenant hereunder; (iii) showing the same to prospective tenants, purchasers or lenders (or to others who may have a financial interest in the Buildings) in a reasonable manner; (iv) emergency entry; (v) making such changes or repairs to the Premises or to any other portion of the Buildings as Landlord may deem necessary or desirable; and (vi) showing the Premises to prospective tenants, during the last one hundred eighty (180) day period before the expiration of the term or before an earlier termination of this Lease; all without being deemed to constitute or cause any eviction of Tenant and without abatement of rent. Tenant hereby waives any claim for damages for any injury or inconvenience to or interference with Tenant’s business, any loss of occupancy or quiet enjoyment of the Premises, and any other loss occasioned thereby. For each of the aforesaid purposes, Landlord shall at all times have and retain a key with which to unlock all of the doors in, upon and about the Premises, excluding Tenant’s vaults and safes, and Landlord shall have the right to use any and all means which Landlord may reasonably deem proper to open said doors in an emergency in order to obtain entry to the Premises, and any entry to the Premises obtained by Landlord by any of said means shall not under any circumstances be construed or deemed to be a forcible or unlawful entry into or a detainer of the Premises, or an eviction of Tenant from the Premises or any portion thereof. Whenever Landlord exercises its right of entry pursuant to this Article X, Landlord shall use its reasonable efforts to maintain the confidentiality of Tenant’s biomedical research records, as required by law. No provision of this Lease shall be construed as obligating Landlord to perform any repairs, alterations or decorations, except as otherwise expressly provided herein. Landlord shall have the right to run utility or other services and facilities through the Premises, whether to service the Premises or other portions of the Buildings. If, during the last month of the Term hereof, Tenant shall have removed substantially all of its property therefrom, Landlord may immediately enter and alter, renovate and redecorate the Premises without eliminating or abating any rent hereunder or incurring any liability to Tenant. Tenant’s property remaining within the Premises at the time of such entry by Landlord may be warehoused by Landlord at Tenant’s sole cost, expense and risk.

ARTICLE

XI

PROPERTY DAMAGE AND PERSONAL INJURY CLAIMS

11.1 Indemnification. Tenant shall indemnify and hold harmless Landlord against and from any and all claims of damage or injury arising from Tenant’s use of the Premises or the conduct of its business or from any activity, work or thing done, permitted or suffered by Tenant in or about the Premises or the Buildings, and shall further indemnify and hold harmless Landlord against and from any and all claims arising from any breach or default in the performance of any obligation of Tenant hereunder, or arising from any act or omission of Tenant, or any of its agents, employees, invitees or licensees, and against and from all costs, attorneys’ fees, consultants’ fees, expenses and liabilities incurred in connection with or as a result of any such claim or any action or proceeding brought thereon (including, without limitation, any and all judgments, fines and costs of appeal and costs of settlement), and in case any action or proceeding is brought against Landlord by reason of any such claim, Landlord shall give Tenant, upon notice from Landlord, the option to defend the same at Tenant’s expense with counsel selected by Tenant and reasonably acceptable to Landlord; provided, however, that should Tenant elect not to defend any such claim, Tenant shall reimburse Landlord for Landlord’s out-of-pocket expenses (including reasonable attorneys’ fees and expenses and costs of investigation) which are incurred as a result of any investigation, defense or settlement relating to the foregoing, which reimbursement shall be made to Landlord upon receipt by Tenant of invoices reflecting in reasonable detail such expenses incurred by Landlord.

| 24 |

11.2 Procedure.

(a) As a condition of the indemnification provided for in this Article 11, Landlord will promptly notify Tenant in writing of any third-party claim giving rise to indemnification hereunder and shall tender the defense thereof to Tenant. Tenant shall have the right, but not the obligation, to assume sole control of the defense, settlement or disposition thereof, including, without limitation, the selection of defense counsel provided that such defense counsel is reasonably acceptable to Landlord. Landlord will cooperate in good faith with Tenant in the defense and settlement of all such third-party claims at Tenant’s request and expense. Tenant will keep Landlord advised concerning the relevant claim(s), and the Tenant shall not admit liability with respect thereto without the express prior written consent of Landlord. A failure to promptly notify Tenant of a claim shall serve to reduce the indemnity rights of Landlord only to the extent that such delay or failure to promptly notify Tenant actually prejudiced Tenant’s defense of the claim. If Tenant elects to assume any such defense, Tenant shall not be liable for any legal or other expenses subsequently incurred directly by Landlord in connection with such defense.

(b) So long as Tenant is conducting the defense of the claim for liability in accordance with this Article 11, (i) Landlord will not consent to the entry of any judgment or enter into any settlement with respect to the claim without the prior written consent of Tenant, and (ii) Tenant will not consent to the entry of any judgment or enter into any settlement with respect to the claim without the prior written consent of Landlord, which consent will not be unreasonably withheld or delayed; provided, however, that such consent of Landlord will not be required if the judgment or settlement contains a full release of claims against Landlord without an admission of liability. Notwithstanding any other provision of this Section 11.2, if Landlord withholds its consent to a bona fide settlement offer that includes a full release of claims against Landlord without an admission of liability, where but for such action Tenant could have settled such claim, Tenant will be required to indemnify Landlord only up to a maximum of the bona fide settlement offer for which Tenant could have settled such claim.

11.3 Assumption of Liability and Waiver of Claims. Tenant, as a material part of the consideration to Landlord for this Lease, hereby assumes all risk of damage to property or injury to persons in, upon or about the Project from any cause whatsoever, and Tenant hereby waives all claims in respect thereof against Landlord and acknowledges that this assumption and waiver by Tenant has been reflected as a reduction of the rent which Landlord would otherwise charge. Landlord shall not be liable for interference with light, air or other similar benefits, nor shall Landlord be liable for any latent or patent defect in the Project. Tenant shall give prompt notice to Landlord in case of fire or accidents in the Premises or in the Buildings or defects therein or in the fixtures or equipment thereof but Landlord’s receipt of such notice shall not impose upon Landlord any duty, liability or obligation which it has not assumed or which it has disclaimed in this Lease. Landlord shall not be liable for any damage to property entrusted to employees of the Buildings, nor for the loss of or damage to, any property by theft or otherwise, nor for any injury or damage to persons, property or Tenant’s business (or loss of income) resulting from construction, repair or alteration of premises adjoining the Premises, the Premises or any other portion of the Buildings, or from the pipes, appliances or plumbing works therein, or from the roof, street or subsurface, or from any other place, or resulting from dampness or any other cause whatsoever, nor shall Landlord be liable for any damage caused by acts or omissions of other tenants, occupants or visitors of the Project.

| 25 |

ARTICLE

XII

INSURANCE

12.1 Tenant’s Insurance Obligations. From and after the date of delivery of the Premises from Landlord to Tenant, Tenant shall carry and maintain, at its own expense, the following types, amounts and forms of insurance:

12.1.1 Liability Insurance. Tenant shall carry and maintain a policy of comprehensive general liability insurance with a combined single limit of not less than One Million Dollars ($1,000,000) per occurrence and Two Million Dollars ($2,000,000) in the aggregate in the name of Tenant (with Landlord and, if requested by Landlord, any mortgagee, trust deed holder, ground lessor or secured party with an interest in this Lease, the Buildings or the Project named as additional insured(s)). Such policy shall specifically include, without limitation, personal injury, broad form property damage and contractual liability coverage, the last of which shall cover the insuring provisions of this Lease and the performance by Tenant of the indemnity agreements in Article XI above. The amount of such insurance required hereunder shall be subject to adjustment from time to time as reasonably requested by Landlord.

12.1.2 Property Insurance. Tenant shall carry and maintain a policy or policies of property insurance in the name of Tenant (with Landlord and, if requested by Landlord, any mortgagee, trust deed holder, ground lessor or secured party with an interest in this Lease, the Building or the Project named as additional insured(s)) covering any tenant improvements in the Premises and Alterations and any property of Tenant at the Premises and providing protection against all perils included within the classification of fire, extended coverage, vandalism, malicious mischief, special extended peril (all risk) and sprinkler leakage, in an amount equal to at least one hundred percent (100%) of the replacement cost thereof from time to time (including, without limitation, cost of debris removal).

12.1.3 Workers’ Compensation Insurance. Tenant shall carry and maintain a policy of workers’ compensation insurance in compliance with all applicable laws.

| 26 |

12.1.4 Other Insurance. Tenant shall carry and maintain such other policies of insurance (including, without limitation, business interruption insurance) in connection with the Premises as Landlord may from time to time require.

12.1.5 Policy Provisions. All of the policies required to be obtained by Tenant pursuant to the provisions of this Section 12.1 shall be issued by companies, and shall be, in form and content, reasonably acceptable to Landlord. Without limiting the generality of the foregoing, any deductible amounts under said policies shall be subject to Landlord’s approval. Each policy shall designate Landlord as an additional named insured and shall provide full coverage in the amounts set forth herein. Although named as an insured, Landlord shall be entitled to recover under said policies for any loss occasioned to Landlord, its servants, agents and employees, by reason of the negligence of Tenant. Tenant shall, prior to delivery of the Premises by Landlord to Tenant, provide Landlord with copies of and certificates for all insurance policies. All insurance policies shall provide that they may not be altered or canceled until after thirty (30) days written notice to Landlord (by any means described in Article XXII below). Tenant shall, at least thirty (30) days prior to the expiration of any of such policies, furnish Landlord with a renewal or binder therefor. Tenant may carry insurance under a so-called “blanket” policy, provided that such policy provides that the amount of insurance required hereunder shall not be prejudiced by other losses covered thereby. All insurance policies carried by Tenant shall be primary with respect to, and non-contributory with, any other insurance available to Landlord and shall contain cross-liability coverage. If Tenant fails to carry any insurance policy required hereunder or to furnish copies thereof and certificates therefor pursuant hereto, Landlord may obtain such insurance, and Tenant shall reimburse Landlord for the costs thereof with the next monthly rent payments due hereunder.

12.2 Landlord’s Insurance Obligations. During the Term of this Lease, Landlord shall keep and maintain fire and extended coverage insurance with vandalism and malicious mischief endorsement for the Buildings and public liability insurance or an equivalent funded program of self-insurance in such reasonable amounts with such reasonable deductibles as would be carried by a prudent owner of a similar building in Southern California. Landlord may obtain insurance for the Buildings and the rents from the Buildings against such other perils as Landlord may reasonably consider appropriate. Tenant acknowledges that it will not be a named insured in such policies and that it has no right to receive any proceeds from any such insurance policies carried by Landlord. Landlord shall not be required to carry insurance covering the property described in Section 12.1.2 above.

12.3 Waivers of Subrogation. Each of the parties hereto waives any and all rights of recovery against the other or against any other tenant or occupant of the Buildings, or against the officers, employees, agents, representatives, patients or visitors of such other party or of such other tenant or occupant of the Buildings, for loss of or damage to such waiving party or its property or the property of others under its control and arising from any cause insured against under any insurance required to be carried by such waiving party pursuant to this Lease or arising from any cause insured against under any standard form of first insurance policy with all permissible extension endorsements covering additional perils carried by such waiving party or under any other policy of insurance carried by such waiving party in lieu thereof, to the extent such loss or damage is insured against by such policy.

| 27 |

12.4 Increases. Tenant shall pay any increases in insurance premiums relating to property in the Project other than the Premises to the extent that any such increase is specified by the insurance carrier as being caused by Tenant’s acts or omissions or use or occupancy of the Premises.

ARTICLE

XIII

DAMAGE OR DESTRUCTION OF BUILDING OR PREMISES