UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

Nile Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

115 Sansome Street, Suite 310

San Francisco, California 94104

April 18, 2008

Dear Nile Therapeutics, Inc. Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Nile Therapeutics, Inc., which will be held on Thursday, May 29, 2008 at 9:30 a.m., Eastern Daylight Time, at One Liberty Plaza, 165 Broadway, 50th Floor, New York, NY 10006.

Details of the business to be conducted at the meeting are given in the attached Notice of Annual Meeting of Stockholders and the attached Proxy Statement.

In order to ensure your representation at the meeting, please complete, sign and date the enclosed proxy as promptly as possible and return it in the enclosed postage-prepaid envelope (no postage need be affixed if mailed in the United States). Please mail the completed proxy card whether or not you plan to attend the meeting.

We look forward to seeing you at the meeting.

| /s/ Peter M. Strumph |

| Peter M. Strumph |

| Chief Executive Officer |

San Francisco, California

YOUR VOTE IS IMPORTANT TO US

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 29, 2008

Notice is hereby given that the 2008 Annual Meeting of Stockholders of Nile Therapeutics, Inc., a Delaware corporation, or the Company, is to be held on Thursday, May 29, 2008 at 9:30 a.m., Eastern Daylight Time, at One Liberty Plaza, 165 Broadway, 50th Floor, New York, NY 10006, for the following purposes:

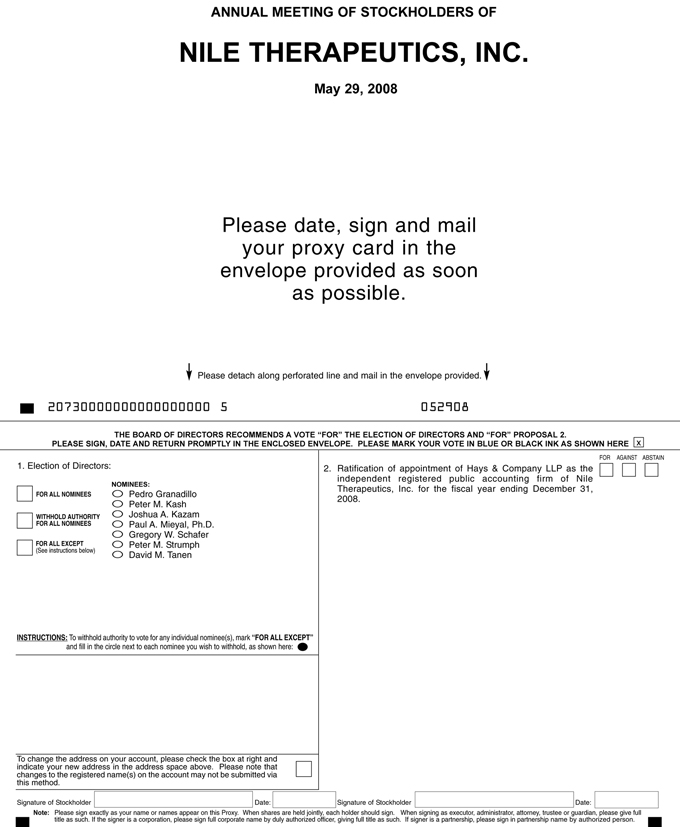

| (1) | To elect directors to hold office until our 2009 Annual Meeting of Stockholders, or until their respective successors have been elected and have qualified, or until their earlier resignation or removal; |

| (2) | To ratify the appointment of Hays & Company LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2008; and |

| (3) | To transact such other business as may properly come before the meeting or any adjournment thereof. |

These matters are more fully described in the proxy statement accompanying this notice.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. The record date for determining those stockholders who will be entitled to notice of, and to vote at, the meeting and at any adjournments thereof is March 31, 2008.

Whether or not you plan to attend the meeting, please vote as soon as possible. You may vote by mailing a completed proxy card. A postage-prepaid envelope is enclosed for the submission of your proxy card. You may revoke a previously delivered proxy at any time prior to the meeting. If you are a stockholder of record and decide to attend the meeting and wish to revoke your proxy, you may do so automatically by voting in person at the meeting. If your shares are held by a broker or other nominee, and you would like to vote in person at the meeting, you will need to obtain a legal proxy from your broker or nominee and present it at the meeting.

| By Order of The Board of Directors, |

| /s/ Peter M. Strumph |

| Peter M. Strumph |

| Chief Executive Officer |

San Francisco, California

April 18, 2008

IMPORTANT

TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, PLEASE MARK, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS SOON AS POSSIBLE IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE IN PERSON EVEN IF YOU RETURNED A PROXY.

115 Sansome Street, Suite 310

San Francisco, California 94104

2008 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD

MAY 29, 2008

PROXY STATEMENT

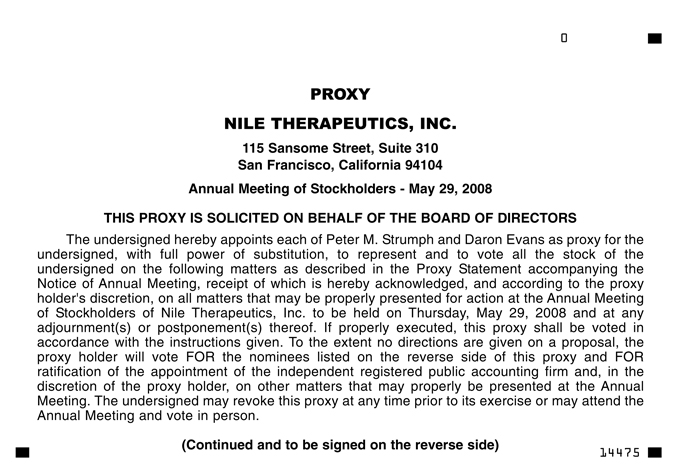

SOLICITATION OF PROXIES

This proxy statement is furnished to our stockholders as of March 31, 2008, the record date, in connection with the solicitation of proxies by our Board of Directors for use at our annual meeting of stockholders, to be held at One Liberty Plaza, 165 Broadway, 50th Floor, New York, NY 10006, on Thursday, May 29, 2008 at 9:30 a.m., Eastern Daylight Time, and at any adjournments or postponements of the meeting. This proxy statement and the proxy card, together with a copy of our Annual Report on Form 10-KSB for our fiscal year ended December 31, 2007, is first being mailed to our stockholders on or about April 18, 2008. Our telephone number is (415) 875-7880.

QUESTIONS AND ANSWERS REGARDING THIS SOLICITATION AND VOTING AT THE MEETING

| Why am I receiving this proxy statement? |

You are receiving this proxy statement from us because you were a stockholder of record at the close of business on the record date of March 31, 2008. As a stockholder of record, you are invited to attend our annual meeting of stockholders and are entitled to vote on the items of business described in this proxy statement. This proxy statement contains important information about the meeting and the items of business to be transacted at the meeting. You are strongly encouraged to read this proxy statement, which includes information that you may find useful in determining how to vote. |

| Who is entitled to attend and vote at the meeting? |

Only holders of record of shares of our common stock at the close of business on March 31, 2008 (the record date) are entitled to notice of, to attend and to vote at the meeting and any adjournments or postponements of the meeting. |

| How many shares are outstanding? |

On the record date, 24,099,716 shares of our common stock were issued and outstanding and held by approximately 210 holders of record, which does not include approximately 120 shareholders which hold our stock in street name. Each share of common stock outstanding on the record date is entitled to one vote. |

| How many shares must be present or represented to conduct business at the meeting (that is, what constitutes a quorum)? |

The presence at the meeting, in person or represented by proxy, of the holders of at least a majority of the shares of our common stock, issued and outstanding on the record date and entitled to vote at the meeting, will constitute a quorum for the transaction of business. If, however, a quorum is not present, in person or represented by proxy, |

1

| then either the chairman of the meeting or the stockholders entitled to vote at the meeting may adjourn the meeting until a later time. |

| What items of business will be voted on at the meeting? |

The items of business to be voted on at the meeting are as follows: |

(1) To elect directors to hold office until our 2009 Annual Meeting of Stockholders, or until their respective successors have been elected and have qualified, or until their earlier resignation or removal; and

(2) To ratify the appointment of Hays & Company LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2008.

| What happens if additional matters are presented at the meeting? |

The only items of business that our Board of Directors intends to present at the meeting are set forth in this proxy statement. As of the date of this proxy statement, no stockholder has advised us of the intent to present any other matter, and we are not aware of any other matters to be presented at the meeting. If any other matter or matters are properly brought before the meeting, the person(s) named as your proxyholder(s) will have the discretion to vote your shares on the matters in accordance with their best judgment and as they deem advisable. |

| How does the Board of Directors recommend that I vote? |

Our Board of Directors recommends that you vote your shares “FOR” the election of each of the director nominees identified in this proxy statement and “FOR” the ratification of the appointment of Hays & Company LLP. |

| What shares can I vote at the meeting? |

You may vote all of the shares you owned as of March 31, 2008, the record date, including shares held directly in your name as the stockholder of record and all shares held for you as the beneficial owner through a broker, trustee or other nominee such as a bank. |

| What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

Some of our stockholders hold their shares through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

Stockholders of Record. If your shares are registered directly in your name with our transfer agent, American Stock Transfer and Trust Company, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you by us. As the stockholder of record, you have the right to vote in person at the meeting or direct the proxyholder how to vote your shares on your behalf at the meeting by fully completing, signing and dating the enclosed proxy card and returning it to us in the enclosed postage-paid return envelope.

Beneficial Owner. If your shares are held in a brokerage account or by a trustee or another nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you together with a voting instruction card by your

2

| broker, trustee or other nominee. As the beneficial owner, you have the right to direct your broker, trustee or nominee to vote your shares as you instruct in the voting instruction card. The broker, trustee or other nominee may either vote in person at the meeting or grant a proxy and direct the proxyholder to vote your shares at the meeting as you instruct in the voting instruction card. You may also vote in person at the meeting, but only after you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote your shares at the meeting. Your broker, trustee or nominee has enclosed or provided a voting instruction card for you to use in directing the broker, trustee or nominee how to vote your shares. |

| How can I vote my shares without attending the meeting? |

As discussed previously, whether you hold shares directly as the stockholder of record or as a beneficial owner, you may direct how your shares are voted without attending the meeting by completing and returning the enclosed proxy card or voting instruction card. If you provide specific instructions with regard to items of business to be voted on at the meeting, your shares will be voted as you instruct on those items. Proxies properly signed, dated and submitted to us that do not contain voting instructions and are not revoked prior to the meeting will be voted “FOR” the election of each of the director nominees identified in this proxy statement and “FOR” the ratification of the appointment of Hays & Company LLP. |

| How can I vote my shares in person at the meeting? |

Shares held in your name as the stockholder of record may be voted in person at the meeting. Shares held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares at the meeting. You should be prepared to present photo identification for admittance. Please also note that if you are not a stockholder of record but hold shares through a broker, trustee or nominee, you will need to provide proof of beneficial ownership as of the record date, such as your most recent brokerage account statement, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership. The meeting will begin promptly at 9:30 a.m. EDT. Check-in will begin at 9:00 a.m. EDT. Even if you plan to attend the meeting, we recommend that you also complete, sign and date the enclosed proxy card or voting instruction card and return it promptly in the accompanying postage-paid return envelope in order to ensure that your vote will be counted if you later decide not to, or are unable to, attend the meeting. |

| Can I change my vote or revoke my proxy? |

You may change your vote or revoke your proxy at any time prior to the vote at the meeting. If you are the stockholder of record, you may change your vote by granting a new proxy bearing a later date, which automatically revokes the earlier proxy, by providing a written notice of revocation to our Corporate Secretary prior to your shares being voted, or by attending the meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request. |

3

If you are a beneficial owner, you may change your vote by submitting a new voting instruction card to your broker, trustee or nominee, or, if you have obtained a legal proxy from your broker, trustee or nominee giving you the right to vote your shares, by attending the meeting and voting in person.

| Is my vote confidential? |

Proxy cards, voting instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed, except as required by law to American Stock Transfer and Trust Company, our transfer agent, to allow for the tabulation of votes and certification of the vote, and to facilitate a successful proxy solicitation. |

| How are votes counted and what vote is required to approve each item? |

Each outstanding share of our common stock entitles the holder to one vote per share on each matter considered at the meeting. Stockholders are not entitled to cumulate their votes in the election of directors or with respect to any matter submitted to a vote of the stockholders. The election of directors requires a plurality of the votes cast for the election of directors and, accordingly, the director nominees receiving the highest number of affirmative “FOR” votes at the meeting will be elected to serve as directors. You may vote either “FOR” or “WITHHOLD” your vote for the director nominees. A properly executed proxy marked “WITHHOLD” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. |

Stockholder ratification of the appointment of Hays & Company LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008 is not required by law or by governing instruments. Our Board of Directors, however, is submitting the selection of Hays & Company LLP to our stockholders for ratification as a matter of good corporate governance and practice. The ratification of the appointment of Hays & Company LLP requires a majority of the votes cast. You may vote either “FOR” or “AGAINST” ratification of the appointment, or you may abstain. A properly executed proxy marked “ABSTAIN” with respect to the ratification of the appointment will not be voted with respect to such ratification, although it will be counted for purposes of determining both whether there is a quorum and the total number of votes cast with respect to the proposal. If the stockholders fail to ratify the appointment, the audit committee of our Board of Directors will reconsider whether or not to retain that firm.

| What is a “broker non-vote”? |

Under the rules that govern brokers and banks who have record ownership of our shares of common stock that are held in street name for their clients such as you, who are the beneficial owners of the shares, brokers and banks have the discretion to vote such shares on routine matters. The election of directors and the ratification of the appointment of independent registered public accounting firms are considered routine matters. |

4

| How are “broker non-votes” counted? |

Broker non-votes will be counted as present for the purpose of determining the presence or absence of a quorum for the transaction of business, but they will not be counted in tabulating the voting result for any particular proposal. |

| How are abstentions counted? |

If you return a proxy card that indicates an abstention from voting on all matters, the shares represented by your proxy will be counted as present for the purpose of determining both the presence of a quorum and the total number of votes cast with respect to a proposal (other than the election of directors), but they will not be counted in tabulating the voting results for any particular proposal. As a result, an abstention will have the same effect as a vote against a proposal. |

| What happens if the meeting is adjourned? |

If our annual meeting is adjourned to another time and place, no additional notice will be given of the adjourned meeting if the time and place of the adjourned meeting is announced at the annual meeting, unless the adjournment is for more than 30 days, in which case a notice of the adjourned meeting will be given to each stockholder of record entitled to vote at the adjourned meeting. At the adjourned meeting, we may transact any items of business that might have been transacted at the annual meeting. |

| Who will serve as inspector of elections? |

A representative of American Stock Transfer and Trust Company, our transfer agent, will tabulate the votes and act as inspector of elections at the meeting. |

| What should I do in the event that I receive more than one set of proxy materials? |

You may receive more than one set of these proxy solicitation materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. In addition, if you are a stockholder of record and your shares are registered in more than one name, you may receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card that you receive to ensure that all your shares are voted. |

| Who is soliciting my vote and who will bear the costs of this solicitation? |

The enclosed proxy is being solicited on behalf of our Board of Directors. We will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement. In addition to solicitation by mail, our directors, officers and employees may also solicit proxies in person, by telephone, by electronic mail or by other means of communication. We will not pay any additional compensation to our directors, officers or other employees for soliciting proxies. Copies of the proxy materials will be furnished to brokerage firms, banks, trustees, custodians and other nominees holding beneficially owned shares of our common stock, who will forward the proxy materials to the beneficial owners. We may reimburse brokerage firms, banks, trustees, custodians and other agents for the costs of forwarding the proxy materials. Our costs for forwarding proxy materials will not be significant. |

5

| Where can I find the voting results of the meeting? |

We intend to announce preliminary voting results at the meeting, and publish the final voting results in our quarterly report on Form 10-QSB for the second quarter of fiscal year 2008. |

| What is the deadline for submitting proposals for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors? |

As a stockholder, you may be entitled to present proposals for action at a future meeting of stockholders, including director nominations. |

6

Stockholder Proposals

Under the rules of the Securities and Exchange Commission, or SEC, for stockholder proposals to be considered for inclusion in the proxy statement for the 2009 Annual Meeting, they must be submitted in writing to our Corporate Secretary, Nile Therapeutics, Inc., 115 Sansome Street, Suite 310, San Francisco, California 94104. For a stockholder proposal to be considered for inclusion in our proxy statement for the annual general meeting to be held in 2009, the proposal must be in writing and received by us no later than January 29, 2009, or such proposal will be considered untimely under the Securities Exchange Act of 1934, as amended, or the Exchange Act. If the date of our 2009 Annual Meeting is more than 30 days before or 30 days after the anniversary date of our 2008 Annual Meeting, the deadline for inclusion of proposal in our proxy statement will instead be a reasonable time before we begin to print and mail our proxy materials. Shareholder proposals must comply with the requirements of Rule 14a-8 of the Exchange Act and any other applicable rules established by the Securities and Exchange Commission. Shareholders are also advised to review our certificate of incorporation and bylaws, which contain additional requirements with respect to advance notice of stockholder proposals.

Nomination of Director Candidates

Any proposals for director candidates for consideration by our Board of Directors must be in writing and include the nominee’s name and qualifications for board membership and should be directed to our Corporate Secretary at our principal executive offices. Our bylaws also require that any proposal for nomination of directors include the consent of each nominee to serve as a member of our Board of Directors, if so elected. Stockholders are also advised to review our bylaws, which contain additional requirements with respect to stockholder nominees for our Board of Directors. In addition, the stockholder must give timely notice to our Corporate Secretary in accordance with the provisions of our bylaws, which require that the notice be received by our Corporate Secretary at least 30 days prior to the 2009 Annual Meeting.

In accordance with Delaware law, a list of stockholders entitled to vote at the meeting will be available at the meeting, and for 10 days prior to the meeting at our offices located at 115 Sansome Street, Suite 310, San Francisco, California 94104 between the hours of 9:00 a.m. and 5:00 p.m. Pacific Time.

7

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

NOMINEES

The Company’s Board of Directors currently consists of seven members. Each of the seven directors will be re-elected at the Annual Meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them at the Annual Meeting for the seven current directors of the Company named as nominees below. The proxies cannot be voted for a greater number of persons than the number of nominees nominated. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board of Directors to fill the vacancy. It is not expected that any nominee will be unable to or will decline to serve as a director. If stockholders nominate additional persons for election as directors, the proxy holder will vote all proxies received by him to assure the election of as many of the Board of Directors’ nominees as possible, with the proxy holder making any required selection of specific nominees to be voted for. The term of office of each person elected as a director will continue until the next Annual Meeting of Stockholders wherein directors are elected, or until such person’s successor has been elected.

VOTE REQUIRED

The seven nominees receiving the highest number of affirmative votes of the votes cast shall be elected as directors of the Company for the ensuing year.

RECOMMENDATION

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” EACH OF THE NOMINEES NAMED IN THIS PROPOSAL NO. 1. UNLESS YOU INDICATE OTHERWISE, YOUR PROXY WILL BE VOTED “FOR” EACH OF MESSRS. GRANADILLO, KASH, KAZAM, SCHAFER, STRUMPH AND TANEN AND DR. MIEYAL.

DIRECTOR NOMINEES

Set forth below is information regarding each nominee for election to our Board of Directors, including his age as of March 31, 2008, his positions and offices held with the Company and certain biographical information:

| Name of Nominee |

Age |

Position and Offices Held in the Company |

Director Since * | |||

| Pedro Granadillo |

60 | Director | October 2007 | |||

| Peter M. Kash |

46 | Chairman of the Board, Director | September 2007 | |||

| Joshua A. Kazam |

31 | Director | September 2007 | |||

| Paul A. Mieyal, Ph.D. |

38 | Director | September 2007 | |||

| Gregory W. Schafer |

43 | Director | January 2008 | |||

| Peter M. Strumph |

43 | Chief Executive Officer, Director | September 2007 | |||

| David M. Tanen |

36 | Secretary and Director | September 2007 |

| * | We were incorporated in the State of Nevada on June 17, 1996 and reincorporated in Delaware on February 9, 2007, at which time our name was SMI Products, Inc., or SMI. From inception through August 11, 2006, SMI was a development stage company in the business of internet real estate mortgage services. On and after August 11, 2006, SMI ceased its prior business. On September 17, 2007, we completed a merger transaction whereby Nile Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of SMI, merged with and into Nile Therapeutics, Inc., a privately held Delaware corporation, or Old Nile, with Old Nile becoming a wholly-owned subsidiary of SMI. Immediately following the merger described above, we filed a Certificate of Ownership with the Secretary of State of the |

8

| State of Delaware pursuant to which we merged Old Nile with and into us, with us remaining as the surviving corporation to that merger. In connection with that short-form merger, and as set forth in the Certificate of Ownership, we changed our name to “Nile Therapeutics, Inc.,” or Nile. We refer to these two transactions as the “Merger.” Dates listed in the table above do not include services as a director of Old Nile. See biographies below for more details. |

Set forth below are descriptions of the backgrounds of each member of the Board of Directors, his principal occupations for at least the past five years and his current public-company directorships.

Pedro Granadillo has served as a director of the Company since October 16, 2007 and also serves as Chairman of the Compensation Committee and as a member of the Nominating and Corporate Governance Committee. Mr. Granadillo served as Senior Vice President for Eli Lilly and Company, or Lilly, until 2004 when he retired after 34 years of service. He was a member of Lilly’s Policy Committee, which was comprised of its top seven executives. As Lilly’s top human resources, manufacturing and quality executive, he was responsible for policies affecting a global workforce of more than 45,000 employees, as well as, a broad network of manufacturing facilities for its extensive line of products. He also oversaw more than 20 sites and 13,000 employees involved in the manufacturing of Lilly’s conventional “small-molecule” pharmaceuticals and “large-molecule” biotech therapies. Mr. Granadillo currently serves as a director of Noven Pharmaceuticals, Inc. and Haemonetics Corporation, both of which are public reporting companies. Mr. Granadillo received his B.S. in Industrial Engineering from Purdue University.

Peter M. Kash served as a director of Old Nile since its inception and has served as a director of the Company since the Merger in September 2007. Mr. Kash also serves as the Chairman of the Board, as well as the Chairman of the Nominating and Corporate Governance Committee, and a member of the Compensation Committee and Audit Committee. In September 2004, Mr. Kash co-founded Two River, a venture capital firm that specializes in the creation of new companies to acquire rights to commercially develop early stage biotechnology products. He serves the President and Chairman of Two River’s managing member, Two River Group Management, LLC. Mr. Kash is also the President and Chairman of Riverbank, a broker-dealer registered with the Financial Industry Regulatory Authority, or FINRA (formerly NASD), broker-dealer. From 1992 until 2004, Mr. Kash was a Senior Managing Director of Paramount BioCapital, Inc., a FINRA (formerly NASD) member broker dealer, specializing in conducting private financings for public and private development stage biotechnology companies as well as Paramount BioCapital Investments, LLC, a venture capital company. Mr. Kash also served as Director of Paramount Capital Asset Management, Inc. (the Paramount companies are collectively referred to as Paramount), the general partner of several biotechnology-related hedge funds and as member of the General Partner of the Orion Biomedical Fund, LP, a private equity fund. Mr. Kash received his B.S. in Management Science from SUNY Binghamton and his M.B.A. in Banking and International Finance from Pace University. Mr. Kash is currently seeking his doctorate in education at Yeshiva University.

Joshua A. Kazam served as a director of Old Nile since its inception and has served as a director of the Company since the Merger in September 2007. In September 2004, Mr. Kazam co-founded Two River and currently serves as Vice President and Director of Two River’s managing member, Two River Group Management, LLC. Mr. Kazam also serves as an Officer and Director of Riverbank. From 1999 to 2004, Mr. Kazam was a Managing Director of Paramount, where he was responsible for ongoing operations of venture investments, and as the Director of Investment for the Orion Biomedical Fund, LP. Mr. Kazam currently serves as a director of Velcera, Inc. a public reporting company. Mr. Kazam is a graduate of the Wharton School of the University of Pennsylvania.

Paul Mieyal, Ph.D., CFA was appointed to serve as a director of the Company on September 11, 2007. Dr. Mieyal also serves as a member of the Audit Committee. Since 2006, Dr. Mieyal has served as a Vice President of Wexford Capital LLC, or Wexford, an SEC registered investment advisor with over $5 billion of assets under management located in Greenwich, CT. Prior to that, from 2000 to 2006, he was Vice President in charge of healthcare investments for Wechsler & Co., Inc., a private investment firm and registered broker-

9

dealer. Dr. Mieyal serves as a Director of Nephros, Inc. a public reporting company. Dr. Mieyal received his Ph.D. in Pharmacology from New York Medical College, a B.A. in chemistry and psychology from Case Western Reserve University, and is a Chartered Financial Analyst.

Gregory W. Schafer has served as a director of the Company since January 28, 2008 and also serves as Chairman of the Audit Committee. Mr. Schafer serves as the Vice President and Chief Financial Officer of Onyx Pharmaceuticals, Inc. Prior to Onyx, from 2004 to 2006, Mr. Schafer served as a consultant to several private and public biotechnology companies. From 1997 to 2004, Mr. Schafer held various executive positions at Cerus Corporation, a public biotechnology company, including Vice President and Chief Financial Officer. Prior to joining Cerus, Mr. Schafer worked as a management consultant for Deloitte & Touche LLP. Mr. Schafer holds an M.B.A from the Anderson Graduate School of Management at UCLA and a BSE in Mechanical Engineering from the University of Pennsylvania.

Peter M. Strumph has served as Old Nile’s Chief Executive Officer since June 6, 2007. Following the Merger, Mr. Strumph was elected a director of the Company and appointed Chief Executive Officer of the Company. Prior to joining Nile, from 1997 to 2007, Mr. Strumph worked for CV Therapeutics, Inc., or CVT, which discovers, develops, commercializes and sells cardiovascular therapeutic products. His latest position at CVT was Senior Vice President of Operations. At CVT, at various times, Mr. Strumph had responsibility for several functions including, pharmaceutical development and manufacturing, marketing, quality assurance/control, clinical trial operations, project management and alliance management. Additionally, Mr. Strumph was a member of the CEO Executive Staff, was the Project Team Leader for RanexaTM and served as the Chair of the Product Development Committee. Prior to joining CVT in 1997, Mr. Strumph served as Manager, Operations Planning and Development at Biogen, Inc., where he played an active role in Biogen’s transition from a research based company to a fully integrated profitable biotechnology company. Mr. Strumph received his M.B.A. in Finance and Healthcare Management from The Wharton School at the University of Pennsylvania and his B.S. in Systems Science and Engineering from The University of Pennsylvania. He also served as a Lieutenant in the United States Navy.

David M. Tanen has served as a director of Old Nile since its inception and has served as a director of the Company since the Merger in September 2007. In September 2004, Mr. Tanen co-founded Two River and currently serves as Vice President and Director of Two River’s managing member, Two River Group Management, LLC. Mr. Tanen also serves as an Officer and Director of Riverbank. Prior to founding Two River, from October 1996 to September 2004, Mr. Tanen served as a Director of Paramount. Mr. Tanen also served as member of the General Partner of the Orion Biomedical Fund, LP. Mr. Tanen currently serves as an officer or director of several privately held biotechnology companies. Mr. Tanen received his B.A. from The George Washington University and his J.D. from Fordham University School of Law.

10

DIRECTORS’ COMPENSATION AND BENEFITS

Our directors do not receive any cash fees for their service as a member of our Board of Directors. On January 25, 2008 the Board of Directors approved the grant of options to non-employee members of our Board of Directors. Each director received options to purchase 50,000 shares of our common stock for their services on the Board of Directors. Messrs. Granadillo, Schafer and Kash also received options to purchase an additional 10,000 shares of our common stock for service as the Chairperson of the Compensation Committee, the Audit Committee and the Board, respectively. Such options begin vesting on the date the member began providing services and vest and become exercisable at the rate of one third (1/3rd) of such shares on each of the first, second and third anniversary of that date, while the optionee remains a director, employee, consultant or officer of the Company.

11

CORPORATE GOVERNANCE

Process for Identifying and Evaluating Director Nominees

The Board of Directors is responsible for nominating directors for election at annual meetings of stockholders or to fill vacancies on the Board of Directors. The Board of Directors has delegated the selection and nomination process to the Nominating and Corporate Governance Committee, with the expectation that other members of the Board of Directors, and of management, will be requested to take part in the process as appropriate.

Procedures for Re-Nomination of a Current Director

The Nominating and Corporate Governance Committee reviews, at least annually, the performance of each current director and considers the results of such evaluation when determining whether or not to re-nominate such director for an additional term. In addition to reviewing the qualifications outlined in the “Director Qualifications” section below, in determining whether to recommend a director for re-election, the Nominating and Corporate Governance Committee also considers the director’s past attendance at meetings and participation in and contributions to the activities of the Board of Directors. As part of this analysis, the Nominating and Corporate Governance Committee will also take into account the nature of and time involved in a director’s service on other boards or committees. Following this review, the Nominating and Corporate Governance Committee nominated and recommended that all current members of the Board of Directors be elected to the Board of Directors.

New Candidates

Generally, the Nominating and Corporate Governance Committee identifies candidates for director nominees in consultation with management, through the use of search firms or other advisers, through recommendations submitted by stockholders or through such other methods as the Nominating and Corporate Governance Committee deems to be helpful to identify candidates. Once candidates have been identified, the Nominating and Corporate Governance Committee confirms that the candidates meet all of the minimum qualifications for director nominees established by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee may gather information about the candidates through interviews, detailed questionnaires regarding experience, background and independence, comprehensive background checks from a qualified company of its choosing, or any other means that the Nominating and Corporate Governance Committee deems to be helpful in the evaluation process.

An initial reviewing member of the Nominating and Corporate Governance Committee will make a preliminary determination regarding whether a potential candidate is qualified to fill a vacancy or satisfy a particular need. If so, the full Nominating and Corporate Governance Committee will make an investigation and interview the potential candidate, as necessary, to make an informed final determination. The Nominating and Corporate Governance Committee will meet as a group to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of the Board of Directors. The policy of the Nominating and Corporate Governance Committee is that there be no difference in the manner by which it evaluates director nominees, whether nominated by management, by a member of the Board of Directors or by a stockholder. Based on the results of the evaluation process, the Nominating and Corporate Governance Committee recommends candidates for the Board of Director’s approval as director nominees for election to the Board of Directors. The Nominating and Corporate Governance Committee also recommends candidates for the Board of Director’s appointment to the Committees of the Board of Directors.

Director Qualifications

The Nominating and Corporate Governance Committee is responsible for reviewing with the Board of Directors from time to time the appropriate qualities, skills and characteristics desired of members of the Board

12

of Directors in the context of the needs of the business and current make-up of the Board of Directors. In evaluating the suitability of individual candidates (both new candidates and current members of the Board of Directors), the Nominating and Corporate Governance Committee, in nominating candidates for election, or the Board of Directors, in approving (and, in the case of vacancies, appointing) such candidates, take into account many factors, including:

| • | the ability of a candidate to make independent analytical inquiries; |

| • | the candidate’s general understanding of marketing, finance and other elements relevant to the success of a publicly-traded company in today’s business environment; |

| • | the candidate’s experience in the life sciences industry and with relevant social policy concerns; |

| • | the candidate’s understanding of our business on a technical level; and |

| • | the candidate’s other board service and educational and professional background. |

Each candidate nominee must also possess fundamental qualities of intelligence, honesty, good judgment, high ethics and standards of integrity, fairness and responsibility. A candidate must also have substantial or significant business or professional experience or an understanding of life sciences, finance, marketing, financial reporting, international business or other disciplines relevant to our business.

The Board of Directors evaluates each individual in the context of the Board of Directors as a whole, with the objective of assembling a group that can best perpetuate the success of our business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas.

Procedures for Recommendation of Director Nominees by Stockholders

The Nominating and Corporate Governance Committee will consider director candidates who are recommended by our stockholders. Stockholders, in submitting recommendations to the Nominating and Corporate Governance Committee for director candidates, must comply with our Bylaws as well as the procedures established by the Nominating and Corporate Governance Committee, which provide that the person or group submitting the recommendation must provide the Nominating and Corporate Governance Committee with a notice that sets forth:

| • | all information relating to each nominee that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case, pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, or the Exchange Act; |

| • | information regarding the relationship between the recommending stockholder or recommending stockholder group and the nominee; |

| • | whether the nominee or any immediate family member of the nominee has, during the year of the nomination or the preceding three fiscal years, accepted directly or indirectly certain consulting, advisory, or other compensatory fees from the recommending stockholder or any member of the group of recommending stockholders or any affiliate of any such holder or member; |

| • | such information as may be reasonably required to determine whether the nominee is qualified to serve on the Audit Committee of the Board of Directors; |

| • | such information as may be reasonably required to determine whether the nominee complies with the standards of independence established by the FINRA, if applicable; |

| • | each nominee’s written consent to being named in a proxy statement as a nominee and to serving as a director if elected; |

| • | the name and address of the recommending stockholder or recommending stockholder group giving the notice (and the beneficial owner, if any, on whose behalf the nomination is made); |

13

| • | the class and number of shares of our capital stock that are owned beneficially and of record by such recommending stockholder or recommending stockholder group (and such beneficial owner, if applicable); |

| • | a representation that the recommending stockholder or members of the recommending stockholder group are holders of record of our stock entitled to vote at such meeting and intend to appear in person or by proxy at the meeting to propose such nomination; and |

| • | a representation whether the recommending stockholder or recommending stockholder group (or such beneficial owner, if any), intends to solicit proxies from stockholders in support of such nomination. |

We may request from the recommending stockholder or recommending stockholder group such other information as may reasonably be required to determine whether each person recommended by a stockholder or stockholder group as a nominee meets the minimum director qualifications established by the Board of Directors and to enable us to make appropriate disclosures to stockholders entitled to vote in the next election of directors. Nominees are required to make themselves reasonably available to be interviewed by the Nominating and Corporate Governance Committee and members of management, as determined appropriate by the Nominating and Corporate Governance Committee. We will not accept a stockholder recommendation for a nominee if the recommended candidate’s candidacy or, if elected, Board of Directors membership, would violate applicable state law, federal law or the rules of any exchange or market on which our securities are listed or traded.

Notices should be directed to the attention of the Corporate Secretary, Nile Therapeutics, Inc., 115 Sansome Street, Suite 310, San Francisco, California 94104.

Code of Business Conduct and Ethics

The Board of Directors has adopted a Code of Business Conduct and Ethics, or the Code, that applies to all directors, officers, employees, consultants, contractors and agents, wherever they are located and whether they work for us on a full- or part-time basis. The Code was designed to help such directors, employees and other agents to resolve ethical issues encountered in the business environment. The Code covers topics such as conflicts of interest, compliance with laws, confidentiality of Company information, encouraging the reporting of any illegal or unethical behavior, fair dealing and use of Company assets.

You can access our Guidelines and Code, as adopted by the Board of Directors, at the Corporate Governance page of our website at www.nilethera.com. Please note that information contained on our website is not incorporated by reference in, or considered to be a part of, this Proxy Statement. We may post amendments to or waivers of the provisions of the Code, if any, made with respect to any directors and employees on that website.

Communications with the Board of Directors

We provide a process for stockholders to send communications to the Board of Directors, the non-management members as a group, or any of the directors individually. Stockholders may contact any of the directors, including the non-management directors, by writing to them c/o the Corporate Secretary, Nile Therapeutics, Inc., 115 Sansome Street., Suite 310, San Francisco, California 94104. All communications will be compiled by our Corporate Secretary, and submitted to the Board of Directors or the individual directors, as applicable, on a periodic basis.

Communications from our officers or directors and proposals submitted by stockholders to be included in our definitive proxy statement, pursuant to Rule 14a-8 of the Exchange Act (and related communications) will not be viewed as a stockholder communication. Communications from our employees or agents will be viewed as stockholder communications only if such communications are made solely in such employee’s or agent’s capacity as a stockholder.

14

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s directors and officers and persons who own more than ten percent of a registered class of the Company’s equity securities to file reports of ownership and reports of changes in the ownership with the SEC. Such persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely on its review of the copies of the forms submitted to it during the last fiscal year, the Company believes that, during the last fiscal year, all such reports were timely filed.

15

COMMITTEES AND MEETINGS OF THE BOARD OF DIRECTORS

The Board of Directors held one meeting during 2007 after the Merger. All directors attended the meeting, with the exception of Paul Mieyal. Each director is expected to attend meetings of the Board of Directors and all Committees on which the director sits. A director who is unable to attend a meeting is expected to notify the Chairman of the Board of Directors or the Chairman of the appropriate Committee in advance of such meeting, and, whenever possible, participate in such meeting via teleconference. In addition, the Board of Directors expects that directors will make reasonable efforts to attend annual meetings of stockholders.

The Board of Directors has established three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each Committee of the Board of Directors has a Charter that has been assessed and approved by the Board of Directors. Each Committee reviews the appropriateness of its Charter at least annually. The Charters of these Committees are available on our website at www.nilethera.com.

Audit Committee

The Audit Committee was established on December 10, 2007 at which time Dr. Mieyal and Mr. Kash were appointed as its members. Upon the commencement of his directorship in January 2008, Mr. Schafer was appointed as the Chairman of the Audit Committee. The Audit Committee is responsible for, among other duties, reviewing the Company’s internal audit and accounting processes, reviewing the results and scope of the audit and other services provided by the Company’s independent registered public accounting firm and reviewing and discussing audited financial statements, management’s assessment of internal control over financial reporting under Section 404 of the Sarbanes Oxley Act of 2002 and other accounting matters with the management of the Company. During the last fiscal year, the full Board of Directors performed the functions of the Audit Committee before the committee was established. The Audit Committee is established in accordance with section 3(a)(58)(A) of the Exchange Act. The responsibilities of the Audit Committee include:

| • | meeting with our management periodically to consider management’s analysis of the adequacy of our internal controls and the objectivity of our financial reporting; |

| • | appointing the independent registered public accounting firm, determining the compensation of the independent registered public accounting firm and pre-approving the engagement of the independent registered public accounting firm for audit and non-audit services; |

| • | overseeing the independent registered public accounting firm, including reviewing independence and quality control procedures and experience and qualifications of audit personnel that are providing audit services; |

| • | meeting with the independent registered public accounting firm and reviewing the scope and significant findings of the audits performed by them, and meeting with management and internal financial personnel regarding these matters; |

| • | reviewing our financing plans, management’s analysis of the adequacy and sufficiency of financial and accounting controls, practices and procedures, the activities and recommendations of the auditors and our reporting policies and practices, and reporting recommendations to the full Board of Directors for approval; |

| • | establishing procedures for the receipt, retention and treatment of complaints regarding internal accounting controls or auditing matters and the confidential, anonymous submissions by employees of concerns regarding questionable accounting or auditing matters; and |

| • | preparing the reports required by the SEC rules to be included in our annual proxy statement. |

The Charter of the Audit Committee is available on the internet at http://www.nilethera.com/inv_corp_gov.html.

16

Compensation Committee

The Compensation Committee was established on December 10, 2007 at which time Messrs. Granadillo and Kash were appointed as its members, with Mr. Granadillo serving as Chairman. The purpose of the Compensation Committee is to review and make recommendations to the Board of Directors regarding all forms of compensation to be provided to the executive officers and employees of the Company. The Compensation Committee’s policy is to ensure that senior management will be accountable to the Board of Directors through the effective application of compensation policies applicable to the Company’s executive officers, including performance goals and stock and incentive compensation. In addition, the Compensation Committee strives to attract and retain key management talent, to support the achievement of the Company’s business strategies through the establishment of appropriate compensation components, to ensure the integrity of the Company’s compensation and benefit practices, and to safeguard the interests of the Company’s stockholders. The Compensation Committee is responsible for, among other duties, reviewing and approving the compensation arrangements for the Company’s senior management and any compensation plans in which the executive officers and directors are eligible to participate, and acting as administrator of the Company’s stock option plans, Employee Stock Purchase Plan and such other equity participation plans as may be adopted by the Board of Directors. The Compensation Committee’s role includes coordination and cooperation with other Board committees, management, external auditors, counsel and other committee advisors. During the 2007, the full Board of Directors performed the functions of the Compensation Committee before the committee was established. The responsibilities of the Compensation Committee include:

| • | designing and approving (in consultation with management and the Board of Directors) overall employee compensation policies and recommending to the Board of Directors major compensation programs; |

| • | reviewing and approving the compensation of our Chief Executive Officer and other corporate officers, including salary, bonus and equity awards; and |

| • | producing an annual Compensation Disclosure and Analysis report on executive compensation for inclusion in our proxy materials in accordance with applicable rules and regulations. |

The Charter of the Compensation Committee is available on the internet at http://www.nilethera.com/inv_corp_gov.html.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee was established on December 10, 2007 at which time Messrs. Granadillo and Kash were appointed as its members, with Mr. Kash serving as Chairman. The Nominating and Corporate Governance Committee is responsible for, among other duties, identifying appropriate candidates for nomination to membership on the Board of Directors. The Nominating and Corporate Governance Committee is also responsible for reviewing director nominees recommended by stockholders of the Company. The procedures for making such a recommendation are described in the Company’s bylaws and above in the section entitled “Corporate Governance—Procedures for Recommendation of Director Nominees by Stockholders.” Our Board of Directors has determined that the two members who currently serve on the Nominating and Corporate Governance Committee, Messrs. Granadillo and Kash, are independent under SEC rules and NASDAQ listing standards. During 2007, the full Board of Directors performed the functions of the Nominating and Corporate Governance Committee before the committee was established. The responsibilities of the Nominating and Corporate Governance Committee include:

| • | selecting or recommending qualified candidates for election to the Board of Directors and appointment to the Committees of the Board of Directors; |

| • | evaluating and reviewing the performance of existing directors; |

| • | making recommendations to the Board of Directors regarding governance matters, including our Certificate of Incorporation, Bylaws and Charters of the Committees of the Board of Directors; and |

17

| • | developing and recommending to the Board of Directors applicable governance and nominating guidelines. |

The Charter of the Nominating and Corporate Governance Committee is available on the internet at http://www.nilethera.com/inv_corp_gov.html.

Compensation Committee Interlocks and Insider Participation

Messrs. Granadillo and Kash served as the members of the Compensation Committee for the year ended December 31, 2007. No member of the Compensation Committee has at any time served as an officer or been otherwise employed by us. None of our executive officers currently serves, or in the past year has served, as a member of the Board of Directors or Compensation Committee of any other entity that has executive officers who have served on our Board of Directors or Compensation Committee.

18

EXECUTIVE OFFICERS OF THE COMPANY

The executive officers of the Company and their ages as of March 31, 2008 are as follows:

| Name |

Age |

Position |

Executive Officer | |||

| Peter M. Strumph |

43 | Chief Executive Officer | June 2007 | |||

| Daron Evans |

34 | Chief Financial Officer | February 2007 | |||

| Jennifer Hodge |

39 | Vice President, Development | August 2007 | |||

| Scott Navins |

36 | Treasurer | August 2005 |

Peter M. Strumph has served as our Chief Executive Officer since June 6, 2007. See his biography set forth above in the section entitled “Director Nominees.”

Daron Evans. Mr. Evans served as Old Nile’s Chief Operating Officer since February 13, 2007. Following the Merger, Mr. Evans was appointed Chief Financial Officer of the Company. Mr. Evans has over 10 years of professional experience in drug development financial analysis and fiscal control. Prior to joining Nile, from 2006 to 2007, Mr. Evans served as Director of Business Assessment at Vistakon, a Johnson & Johnson company, where he led efforts to improve R&D efficiency and speed to market. Prior to that, from 2004 to 2006, he was a Director of Portfolio & Business Analytics for Scios R&D, a Johnson & Johnson company, where he was responsible for financial controls and reporting for portfolio of six clinical stage programs and five preclinical stage programs. While at Scios, Mr. Evans also served as Project Manager for the European registration trial of nesiritide. Mr. Evans also has experience as co-founder of a biotechnology diagnostic company, and has worked as a Management Consultant in the pharmaceutical industry with Booz Allen Hamilton. Mr. Evans received his M.B.A. from The Fuqua School of Business at the Duke University, his M.S. in Biomedical Engineering from Southwestern Medical School & University of Texas at Arlington and his B.S. in Chemical Engineering from Rice University.

Jennifer Hodge. Beginning August 31, 2007, Ms. Hodge has served as Old Nile’s Vice President, Development. Following the Merger, Ms. Hodge was appointed as Vice President, Development of the Company. Ms. Hodge has 18 years of international drug development experience spanning discovery through commercialization. Prior to joining Nile, from 2000 to 2007, Ms. Hodge worked at CVT where she most recently served as the Director of Project Management. While at CVT, Ms. Hodge held a variety of assignments of increasing scope and responsibility, including management of clinical trial operations staff, leadership of the project management function, starting and running CVT’s alliance management function, Project Team Leader for two development projects, and membership on the CVT Product Development Committee. In addition, Ms. Hodge was responsible for critical special assignments to support CVT’s commercial launch, to improve financial reporting and forecasting accuracy for development projects and to plan for the study start up for CVT’s largest clinical trial. Prior to CVT, Ms. Hodge was a Global Clinical Team Leader at Quintiles, had Clinical Research Associate positions at Otsuka and Solvay, and had pharmacologist and development management responsibilities at the James Black Foundation in London. Ms. Hodge received her B.S. in Biology with Honors in Pharmacology from the University of Edinburgh, UK.

Scott L. Navins. Mr. Navins served as Treasurer of Old Nile since its inception. Following the Merger, Mr. Navins was appointed as Treasurer of the Company. Mr. Navins is the Vice President of Finance at Two River Group. Mr. Navins joined Two River Group in 2005. Prior to joining Two River, from 2004 to 2005 Mr. Navins was the Senior Controller at Westbrook Partners, where he managed the accounting for a $560 million real estate private equity fund, including financial and partner reporting, tax coordination, maintaining internal controls and overseeing a $300 million credit facility, among other things. Before that, from 2002 to 2004 Mr. Navins was a Senior Manager at Morgan Stanley, where he managed the accounting for a $2.4 billion real estate private equity fund. Prior to that Mr. Navins was an Associate in the Finance Group at BlackRock, Inc. and the controller for a high-tech venture capital fund. Mr. Navins graduated with honors from The George Washington University in 1993, where he earned a Bachelor of Accountancy degree. Mr. Navins passed the Uniform Certified Public Accounting examination in 1993.

19

COMPENSATION OF EXECUTIVE OFFICERS

Summary Compensation Table

The following table sets forth all of the compensation awarded to, earned by or paid to our chief executive officer, chief financial officer and our two other most highly compensated executive officers during the fiscal year ended December 31, 2007 (collectively, the “named executive officers”):

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) |

Option Awards ($) (1) |

All Other Compensation ($) |

Total ($) | |||||||||

| Peter M. Strumph Chief Executive Officer, Director |

2007 | 179,840 | 70,378 | (2) | 627,987 | (3) | 3,535 | (4) | 881,740 | ||||||

| Daron Evans Chief Financial Officer |

2007 | 154,876 | 55,380 | (5) | 270,280 | (6) | 103,198 | (7) | 583,734 | ||||||

| Jennifer Hodge Vice President, Development |

2007 | 57,974 | 15,181 | (8) | 35,842 | (9) | 425 | (10) | 109,422 | ||||||

| Allan Gordon Former Chief Executive Officer (11) |

2007 | 116,129 | 100,000 | (12) | 961,675 | (13) | 489,404 | (14) | 1,667,208 |

| (1) | Measured as value of compensation expense recognized by the Company for financial statement reporting purposes in fiscal year 2007, computed pursuant to Financial Accounting Standards Board’s Statement of Financial Accounting Standards No. 123(R), “Share Based Payment.” Further discussion of the Company’s option valuation methodology is contained in Note 10 of the Notes to Audited Financial Statements included in our Annual Report filed on Form 10-KSB for the fiscal year ended December 31, 2007, filed on March 27, 2008. |

| (2) | Mr. Strumph is entitled to an annual performance based bonus of up to $150,000 upon the successful completion of annual corporate and individual performance based milestones. This amount represents the bonus paid to Mr. Strumph for the period from June 6, 2007 to December 31, 2007. |

| (3) | Amount reflects the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2007 in accordance with SFAS 123(R), of the following stock option awards: (i) employment options to purchase 989,572 shares granted on September 17, 2007 at an exercise price of $2.71 per share, which cliff vest over three years; and (ii) performance options to purchase 886,949 shares granted on September 17, 2007 at an exercise price of $2.71 per share, which cliff vest over three years based on the meeting of performance goals outlined in Mr. Strumph’s employment agreement. |

| (4) | All other compensation represents a 401(k) matching contribution made by the Company of $2,325 and a life insurance premium of $1,210. |

| (5) | Mr. Evans is entitled to an annual performance based bonus of up to $38,344 upon the successful completion of annual corporate and individual performance based milestones. The performance bonus paid to Mr. Evans for the period from February 13, 2007 to December 31, 2007 was $30,380. In addition, Mr. Evans received a sign-on bonus of $25,000. |

| (6) | Amount reflects the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2007 in accordance with SFAS 123(R), of the following stock option awards: (i) employment options to purchase 239,896 shares granted on September 17, 2007 at an exercise price of $2.71 per share, which cliff vest over three years; and (ii) performance options to purchase 288,458 shares granted on September 17, 2007 at an exercise price of $2.71 per share, which cliff vest over three years based on the meeting of performance goals outlined in Mr. Evans’ employment agreement. |

| (7) | All other compensation represents a 401(k) matching contribution made by the Company of $5,063, and a life insurance premium of $530. Also included is a payment to Mr. Evans of $64,969, of which $47,785 was used to repay a loan made by Old Nile, and $17,184 represents a tax gross up. Mr. Evans also received a reimbursement for his relocation expenses of $32,636. |

| (8) | Ms. Hodge is entitled to an annual performance based bonus of up to $51,000 upon the successful completion of annual corporate and individual performance based milestones. This amount represents the bonus paid to Ms. Hodge for the period from August 30, 2007 to December 31, 2007. |

20

| (9) | Amount reflects the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2007 in accordance with SFAS 123(R), of employment options to purchase 239,896 shares granted on September 17, 2007 at an exercise price of $2.71 per share, which cliff vest 25% the first year and monthly thereafter. |

| (10) | All other compensation represents a 401(k) matching contribution made by the Company of $425. |

| (11) | Dr. Gordon was the Company’s Chief Executive Officer from December 12, 2006 to May 21, 2007. Pursuant to his separation agreement, Dr. Gordon is entitled to receive his annual base salary, a pro rata portion of his annual bonus, health benefits for one year from his termination date, and stock options to purchase 2.5% of the Company’s common stock on a fully diluted basis on the closing of the Financing (see our Annual Report filed on Form 10-KSB for the fiscal year ended December 31, 2007, filed on March 27, 2008). |

| (12) | Amount represents a sign-on bonus paid to Dr. Gordon on January 31, 2007. |

| (13) | Amount reflects the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2007 in accordance with SFAS 123(R), of options to purchase 593,743 shares granted on September 17, 2007 at an exercise price of $2.71 per share, which vest immediately. The shares were issued outside of the 2005 Stock Option Plan pursuant to his separation agreement. |

| (14) | Includes annual salary of $300,000 and health benefits of $17,986 for one year from his termination date, pursuant to his separation agreement, as well as an annual bonus of $120,000 and a prorated bonus of $46,356. Also included is $5,062, representing a 401(k) contribution made by Company, and a life insurance premium of $1,950. |

Amendment of Employment Agreements and Incentive Stock Option Agreements.

On March 4, 2008, the Board of Directors of the Company approved certain amendments to the Employment Agreement, dated as of May 11, 2007, between the Company and Peter Strumph, and the Incentive Stock Option Agreement, dated as of September 17, 2007, between the Company and Mr. Strumph. In addition, on the same date, the Board approved certain amendments to the Employment Agreement, dated as of January 19, 2007 and amended August 28, 2007, between the Company and Daron Evans, , and the Incentive Stock Option Agreement, dated as of September 17, 2007, between the Company and Mr. Evans. These amendments were made in light of continuously changing business conditions and objectives to give the Board and the Compensation Committee the flexibility to set and modify certain performance goals and to award certain cash bonuses and to vest a certain amount of the stock options of each of Messrs. Strumph and Evans upon the achievement of those performance goals. Specifically, after the effectiveness of the amendments, the Board has ability to vest that number of performance-based stock options in any year, or pro rata portion thereof for a period less than a full year, in an amount equal up to 33.33% of the stock options. The amendments also allow the Board and Compensation Committee to award a cash performance bonus to each of Messrs. Strumph and Evans in amounts equal to up to $150,000 for Mr. Strumph and up to $38,344 for Mr. Evans. Pursuant to the amendments, the Board and Compensation Committee have the authority to award anywhere between $0 and the maximum bonus and 0% and 33.33% of the performance-based stock options for each of Messrs. Strumph and Evans in any particular year, or a pro rata portion for any period of less than a full year, regardless of the achievement of any goals. Pursuant to these amendments, on March 4, 2008, the Board approved cash bonuses to Mr. Strumph and Mr. Evans of $70,378 and $30,380, respectively, and approved vesting of performance based options to purchase 139,008 and 76,528 shares of the Company’s common stock, respectively, for the period ended December 31, 2007.

21

Outstanding Equity Awards at Fiscal Year-End

The table below sets forth certain information concerning exercised and unexercised options held by the named executive officers at December 31, 2007.

| Option Awards | ||||||||||||

| Name |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

Option Exercise Price ($) |

Option Expiration Date | |||||||

| Peter M. Strumph |

— | 989,572 | (1) | — | 2.71 | 9/14/2017 | ||||||

| 139,008 | 747,911 | (2) | — | 2.71 | 9/14/2017 | |||||||

| Daron Evans |

79,965 | 159,931 | (3) | — | 2.71 | 9/14/2017 | ||||||

| 76,528 | 211,930 | (4) | — | 2.71 | 9/14/2017 | |||||||

| Jennifer Hodge |

— | 239,896 | (5) | — | 2.71 | 9/14/2017 | ||||||

| Allan Gordon |

593,743 | (6) | — | — | 2.71 | 9/15/2012 | ||||||

| (1) | The shares subject to the option vest one third, or 329,857 shares, on each of the following dates: June 4, 2008, June 4, 2009, and June 4, 2010. |

| (2) | The shares subject to the option vest, subject to milestone achievements determined by the Board of Directors, a maximum of one third, or 296,640 shares on each of the following dates: June 4, 2008, June 4, 2009, and June 4, 2010. |

| (3) | The shares subject to the option vest one third, or 79,965 shares, on each of the following dates: February 13, 2008, February 13, 2009, and February 13, 2010. |

| (4) | The shares subject to the option vest, subject to milestone achievements determined by the Board of Directors, a maximum of one third, or 96,153 shares on each of the following dates: February 13, 2008, February 13, 2009, and February 13, 2010. |

| (5) | The shares subject to the option vest 25%, or 59,974, on August 30, 2009 and 4,998 each month thereafter. |

| (6) | The shares subject to the option vested immediately on the date of grant. |

Compensation Policy. Our Company’s executive compensation plan is based on attracting and retaining qualified professionals who possess the skills and leadership necessary to enable our Company to achieve earnings and profitability growth to satisfy our stockholders. We must, therefore, create incentives for these executives to achieve both Company and individual performance objectives through the use of performance-based compensation programs. No one component is considered by itself, but all forms of the compensation package are considered in total. Wherever possible, objective measurements will be utilized to quantify performance, but many subjective factors still come into play when determining performance.

Compensation Components. As an early-stage development company, the main elements of our compensation package consist of base salary, stock options and bonus.

Base Salary. As we continue to grow and financial conditions improve, these base salaries, bonuses and incentive compensation will be reviewed for possible adjustments. Base salary adjustments will be based on both individual and Company performance and will include both objective and subjective criteria specific to each executive’s role and responsibility with the Company.

22

SECURITY OWNERSHIP OF DIRECTORS, OFFICERS

AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information known to the Company regarding the beneficial ownership of the Company’s common stock as of March 31, 2008 by:

| • | each of the Company’s directors, |

| • | each named executive officer as defined and named in the Summary Compensation Table appearing herein, |

| • | all directors and executive officers of the Company as a group, and |

| • | each person known by the Company to beneficially own more than five percent of the Company’s common stock (based on information supplied in Schedules 13D and 13G filed with the Securities and Exchange Commission). |

Except as indicated by footnote, and subject to applicable community property laws, each person identified in the table possesses sole voting and investment power with respect to all capital stock shown to be held by that person. The address of each named executive officer and director, unless indicated otherwise by footnote, is c/o Nile Therapeutics, Inc., 115 Sansome Street, Suite 310, San Francisco, California 94104.

23

| Name of Beneficial Owner |

Shares of Nile Common Stock Beneficially Owned (#) (1) |

Options and Warrants Exercisable within 60 Days |

Total Beneficial Ownership |

Percentage of Nile Common Stock Beneficially Owned (%) (1) |

|||||

| Directors and Named Executive Officers |

|||||||||

| Peter M. Strumph (2) |

— | 139,008 | 139,008 | * | |||||

| 115 Sansome St. Suite 310 San Francisco, CA 94105 |

|||||||||

| Daron Evans (3) |

— | 156,493 | 156,493 | * | |||||

| 115 Sansome St. Suite 310 San Francisco, CA 94105 |

|||||||||

| David M. Tanen (4) |

1,507,705 | — | 1,507,705 | 6.26 | % | ||||

| 689 Fifth Avenue, 14th Floor New York, NY 10022 |

|||||||||

| Peter M. Kash (5) |

1,491,744 | 1,051 | 1,492,795 | 6.19 | % | ||||

| 689 Fifth Avenue, 14th Floor New York, NY 10022 |

|||||||||

| Joshua A. Kazam (6) |

1,231,820 | — | 1,231,820 | 5.11 | % | ||||

| 689 Fifth Avenue, 14th Floor New York, NY 10022 |

|||||||||

| Scott L. Navins |

206,912 | — | 206,912 | * | |||||

| 689 Fifth Avenue, 14th Floor New York, NY 10022 |

|||||||||

| Paul Mieyal (7) |

— | — | — | * | |||||

| 411 West Putnam Avenue Greenwich, CT 06830 |

|||||||||

| Pedro Granadillo (8) |

— | — | — | * | |||||

| 689 Fifth Avenue, 14th Floor New York, NY 10022 |

|||||||||

| Gregory W. Schafer (9) |

— | — | — | * | |||||

| 2100 Powell Street Emeryville, CA 94608 |

|||||||||

| Dr. Allan Gordon (10) |

— | 593,743 | 593,743 | * | |||||

| 6936 Bristol Dr. Berkeley, CA 94705 |

|||||||||

| Directors and named executive officers as a group, 10 individuals |

4,438,181 | 890,295 | 5,328,476 | 22.11 | % | ||||

| 5% Shareholders |

|||||||||

| Wexford Capital LLC (11) |

2,606,778 | 16,841 | 2,623,619 | 10.89 | % | ||||

| 411 West Putnam Avenue |

|||||||||

| Greenwich, CT 06830 |

|||||||||

| RIT Capital Partners, Plc |

1,741,690 | — | — | 7.23 | % | ||||

| 27 St. James Place London, UK SW1A 1NR |

|||||||||

| * | represents less than 1%. |

| (1) | Assumes 24,099,716 shares of Nile Common Stock are outstanding. Beneficial ownership is determined in accordance with Rule 13d-3 under the Securities Act, and includes any shares as to which the security or |

24

| stockholder has sole or shared voting power or investment power, and also any shares which the security or stockholder has the right to acquire within 60 days of the date hereof, whether through the exercise or conversion of any stock option, convertible security, warrant or other right. The indication herein that shares are beneficially owned is not an admission on the part of the security or stockholder that he, she or it is a direct or indirect beneficial owner of those shares. |

| (2) | Excludes issued and outstanding options to purchase up to 1,734,483 shares of Nile Common Stock which are not exercisable within 60 days of the date hereof. Pursuant to certain amendments to the Employment Agreement, dated as of May 11, 2007, between the Company and Peter Strumph, the Company’s Chief Executive Officer, and the Incentive Stock Option Agreement, dated as of September 17, 2007, between the Company and Mr. Strumph, on March 4, 2008 the Board approved the vesting of 139,008 performance based options effective March 4, 2008. |