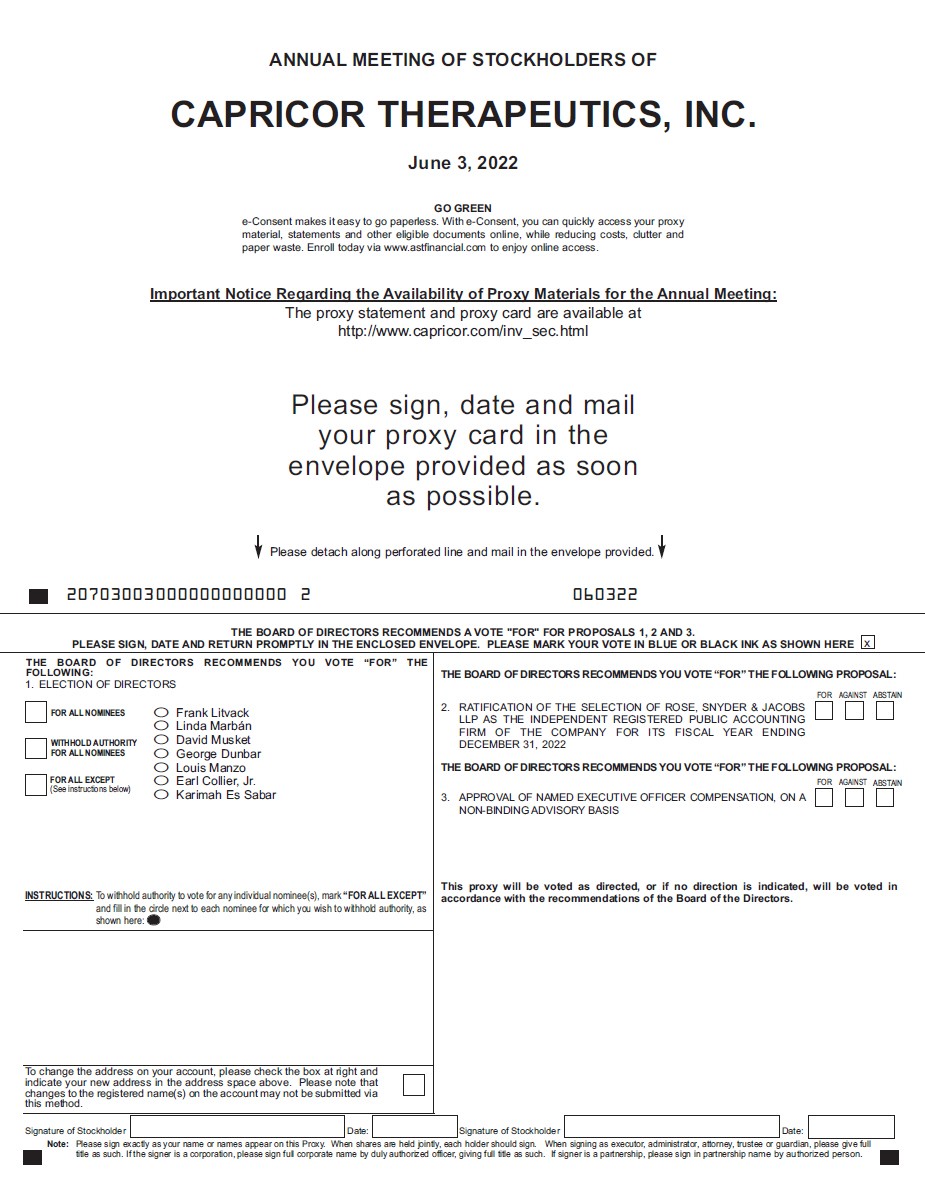

CAPRICOR THERAPEUTICS, INC.

10865 Road to the Cure, Suite 150

San Diego, California 92121

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 3, 2022

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the board of directors (the “Board”) of Capricor Therapeutics, Inc. (sometimes referred to as “we”, “us”, or the “Company”) is soliciting your proxy to vote at the 2022 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements of the Annual Meeting. You are invited to attend the Annual Meeting in person to vote on the proposals described in this proxy statement.

We intend to mail the proxy solicitation materials, combined with the Annual Report on Form 10-K for our fiscal year ended December 31, 2021, including financial statements, to stockholders on or about April 15, 2022. The information on our web site is not part of this proxy statement.

How do I attend the Annual Meeting?

The Annual Meeting will be held on June 3, 2022 at 10:00 a.m. PDT. You may attend in person, at our principal executive offices located at 10865 Road to the Cure, Suite 150, San Diego, California 92121. Information on how to vote in person at the Annual Meeting is discussed below.

Attending in Person: You will need to have a government-issued photo identification along with either your Notice and Access Card or proof of ownership of our shares of common stock as of the Record Date in order to enter the Annual Meeting. Proof of ownership may be any of the following:

A brokerage statement or letter from a bank or broker indicating ownership on the Record Date;

A printout of the proxy distribution email (if you received your materials electronically); or

A voting instruction form received from your bank, broker or nominee.

You are also encouraged to take health and safety considerations into account in determining whether to attend the Annual Meeting in person, and to comply with any laws, executive orders or governmental guidelines in effect in the City of San Diego, the County of San Diego, the State of California, the United States of America, and stockholders’ jurisdictions of residence.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 11, 2022 (the “Record Date”) will be entitled to vote at the Annual Meeting. On the Record Date, there were 24,324,156 shares of our common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If at the close of business on the Record Date, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting in person, we urge you to vote by proxy as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If at the close of business on the Record Date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street