NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 12, 2023

Dear Stockholders of Capricor Therapeutics, Inc.:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Capricor Therapeutics, Inc., a Delaware corporation (the “Company”), which will be held on June 12, 2023 at 10:00 a.m. (PDT), or any adjournment or postponement thereof. The Annual Meeting will be held at the Company’s principal executive office located at 10865 Road to the Cure, Suite 150, San Diego, California 92121.

The Annual Meeting will be held for the following purposes, which are more fully described in the accompanying proxy statement:

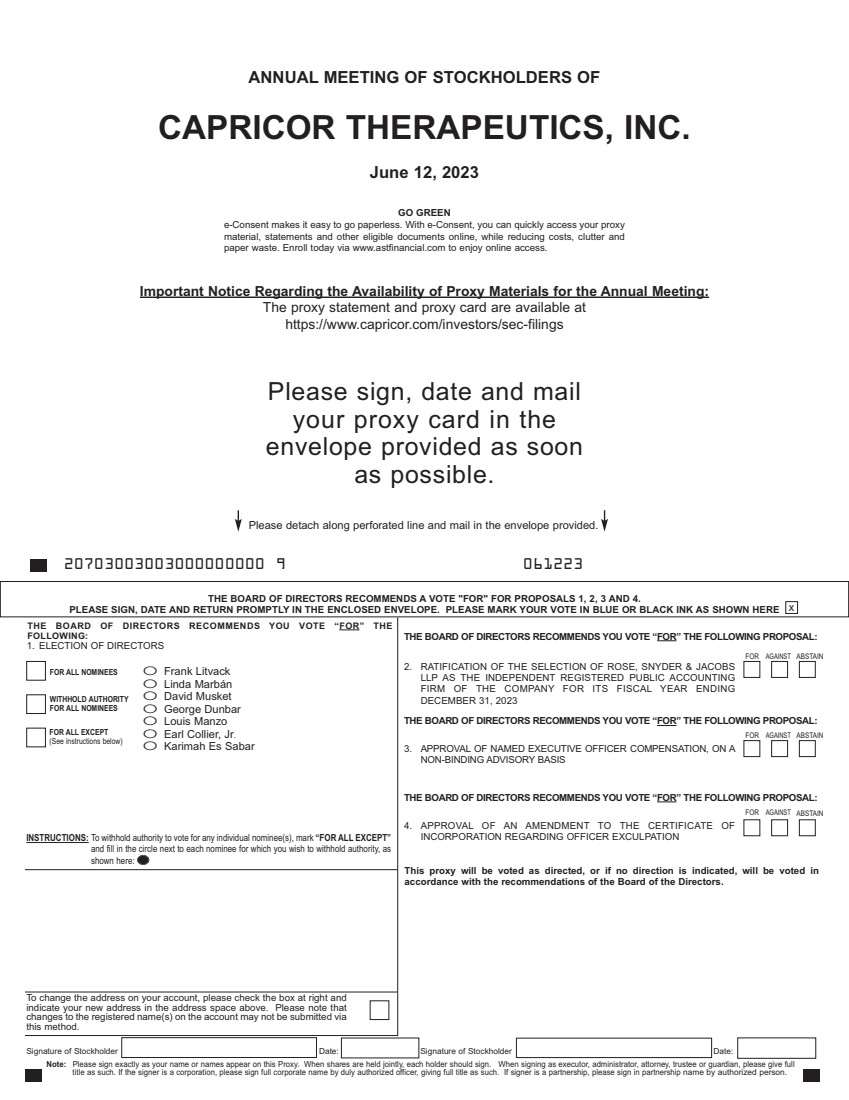

| 1. | To elect the seven (7) nominees named in this proxy statement to the Company’s board of directors to serve for a one-year term expiring at our 2024 Annual Meeting of Stockholders; |

| 2. | To ratify the appointment of Rose, Snyder & Jacobs LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; |

| 3. | To approve, by non-binding advisory vote, the resolution approving named executive officer compensation; |

| 4. | To consider and act upon approval of an amendment to the Certificate of Incorporation regarding officer exculpation; and |

| 5. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The Company’s board of directors has set the Record Date (as defined below) as April 14, 2023. Only stockholders that owned Capricor Therapeutics, Inc. common stock at the close of business on that day are entitled to notice of and may vote at the Annual Meeting or any adjournments or postponements thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on June 12, 2023: Under rules issued by the Securities and Exchange Commission, we are providing access to our proxy materials both by sending you this full set of proxy materials and by notifying you of the availability of our proxy materials on the Internet. |

2